Solana has recently experienced a notable dip in its value, falling below the $95 mark. This development is particularly striking given the generally bullish sentiment prevailing in the broader crypto market, driven partly by excitement over potential Bitcoin ETFs.

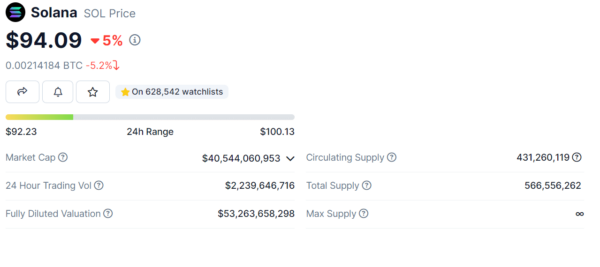

As of January 6, the digital currency trades at $94.09, placing it at a pivotal point. Investors are keen on resistance levels at $108.20, $115.39, and $124.36, which could indicate a shift towards an upward trajectory.

Conversely, support levels at $90.42, $84.38, and $79.32 might provide a buffer against further price drops.

The technical indicators for Solana also paint a cautious picture, with the currency trading below its 50-day Exponential Moving Average (EMA) of $101.97, often interpreted as indicative of a bearish trend.

The Relative Strength Index (RSI) is currently at 34, suggesting a bearish sentiment without indicating an oversold condition. This points to a level of wariness among investors and traders.

As the crypto world is known for its high volatility and rapid changes, those invested in Solana must closely monitor these technical levels and indicators, as they could be crucial in making informed decisions in this dynamic sector.

Also Read: Solana Surpasses Ethereum on Worldwide Google Search Volume