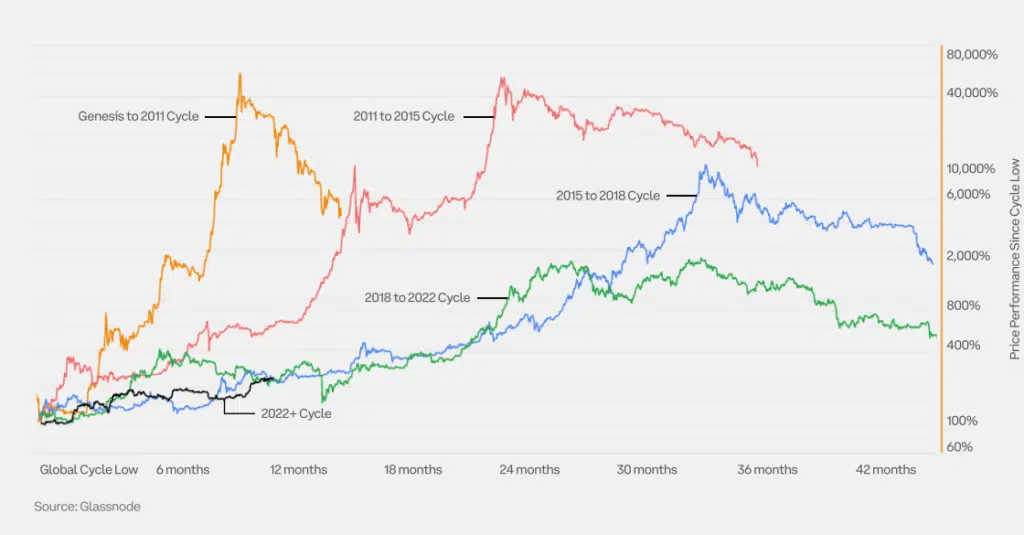

According to Coinbase Research, Bitcoin and Ethereum are at present following a trend similar to that observed between 2018 and 202 Thus far this year. This suggests that the market may see additional growth.

Analysts cite metrics such as net unrealized profit/loss and supply in the candle of profits, suggesting so far that this market is not yet overheated like it did in 2023. This indicates possible further upwards moves.

Prices could also be buoyed by the next Bitcoin halving, due in April 2024 when the block reward will shrink to half. Coinbase Research, however, remains careful to point out that the link between halvings and price rises is still not completely made.

The upcoming Cancun upgrade for Ethereum, scheduled to enhance scalability and security features in its protocols could also result in an increased transaction volume leading potentially to an increased ETH price.

Overall, Coinbase’s research indicates that the current crypto market cycle appears to be on track with this 2018-2022 cycle followed by potential upside before reaching its peak.

Also Real: Economist Peter Schiff Raises Concerns Over Bitcoin ETFs