Standard Chartered Bank made a forecast on Monday suggesting that the price of Bitcoin will exceed $200,000 by the end of 2025, amid anticipated approval of Bitcoin spot ETF applications.

Geoff Kendrick, the head of Standard Chartered digital assets said, “If ETF-related inflows materialize as we expect, we think an end-2025 level closer to USD 200,000 is possible.”

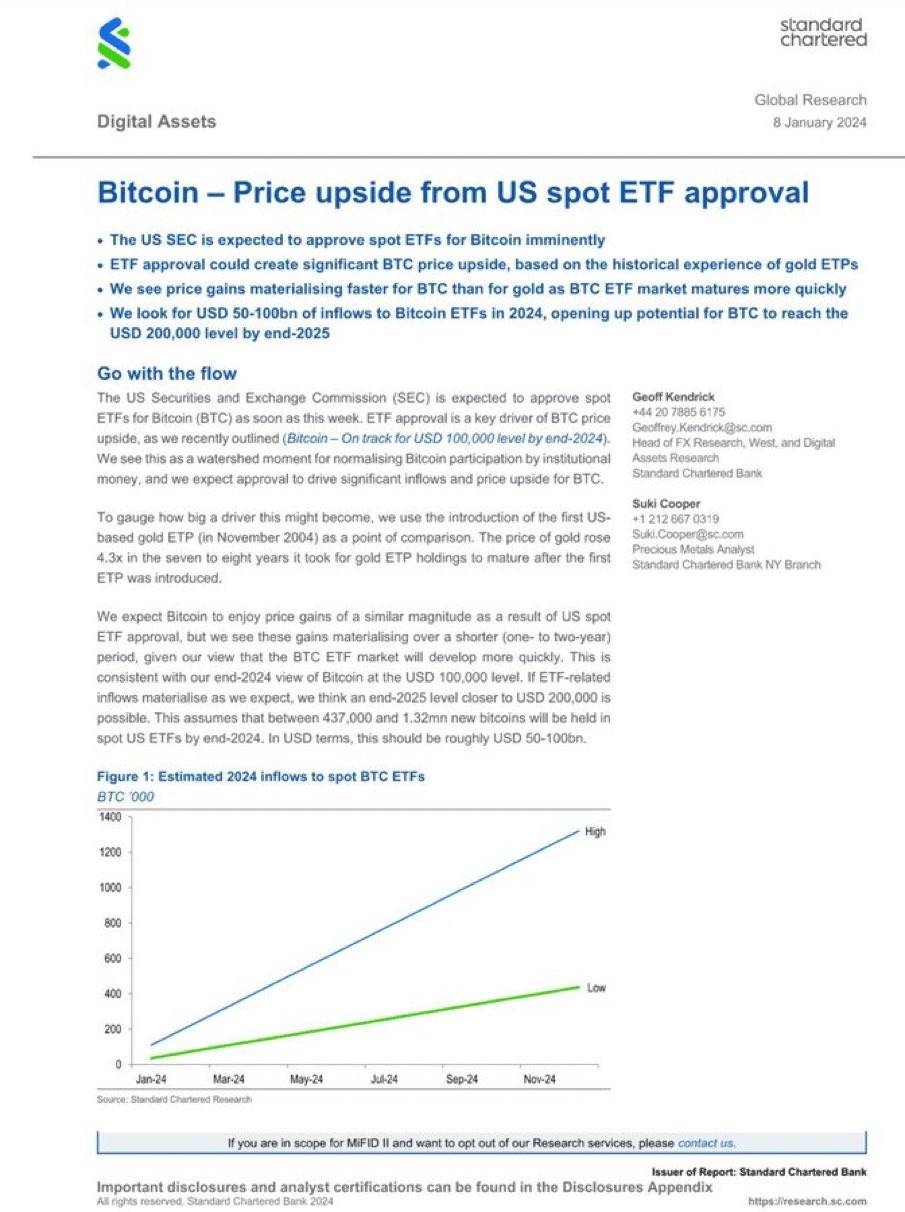

The bank’s forecast hinges on the expectation that by the end of 2024, U.S.-based spot Bitcoin ETFs could hold anywhere from 437,000 to 1.32 million Bitcoins, an estimated influx of $50 to $100 billion into the market.

Kendrick and Cooper believe that Bitcoin will need to grow to $200,000, which is 4.3 times its current value of $47,000.

On the other hand, executives at Standard Chartered pointed out that the value of gold exchange-traded products reached a level 4.3 times their initial value about seven to eight years after they were introduced in November 2004.

Kendrick and Cooper said they view spot Bitcoin ETF approvals as a “watershed moment” for normalizing Bitcoin participation.

The banking executives also noted its latest Bitcoin price prediction is in line with its recent Bitcoin price prediction of $100,000 by the end of 2024.