Analysts at CryptoQuant have presented two possible outcomes for Bitcoin’s price trajectory.

Their analysis hinges on the support and resistance levels determined by the average holding prices of Bitcoin investors, providing insights into both bullish and bearish possibilities.

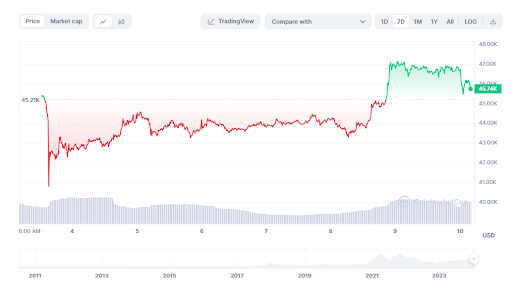

Bitcoin’s value could climb to a local high of $48,500 before the SEC’s verdict. This prediction is based on the increasing involvement of short-term holders who have held their assets for one week or less.

If their share surpasses 8% of total Bitcoin holders, it could signify market overheating and a subsequent price correction. This $48,500 level aligns with the average price held by long-term investors, marking a crucial resistance point.

As Bitcoin recently hit its annual high at $47,218, mirroring levels seen in April 2022, the market eagerly anticipates the SEC’s verdict.

Currently trading at about $45,732, Bitcoin has seen a 7% rise in the past days. The decision on spot Bitcoin ETF applications is highly anticipated and poised to influence the cryptocurrency landscape significantly.

Also Read: Bitcoin’s Price Surges on Hopes of Imminent ETF Approval