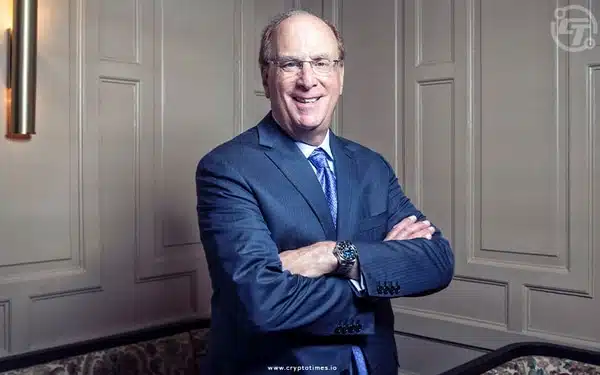

In a CNBC interview today, BlackRock CEO Larry Fink expressed his “seeing value” in the company’s plan to launch a spot Ethereum ETF in the United States, after the successful debut of the company’s new spot Bitcoin ETF product (IBIT).

On Thursday, the trading volume of BlackRock’s spot bitcoin ETF (IBIT) surpassed BITO’s $1 billion first-day bitcoin futures ETF volume in 2021. “I really think this is where we’re going to be going, and these are just stepping stones towards tokenization,” Fink continued.

“I don’t believe it’s ever going to be a currency. I believe it’s an asset class.” Fink stated, “It’s no different than what gold represented over thousands of years,” He added, “Unlike gold, we’re almost at the ceiling of the amount of bitcoin that can be created.”

The largest asset manager in the world, BlackRock, applied for a spot Ethereum ETF to the Securities and Exchange Commission in November of last year, five months after it filed for a spot Bitcoin ETF in June.

Following in the footsteps of its pick of Coinbase Custody as the custodian for its proposed spot Ethereum ETF, BlackRock has dubbed this new trust the iShares Ethereum Trust.

The SEC is expected to approve spot Ethereum ETF funds 70% of the time, according to a recent estimate by Bloomberg ETF expert Eric Balchunas. The agency’s first final decision on an application from Ark and 21Shares is due on May 23.