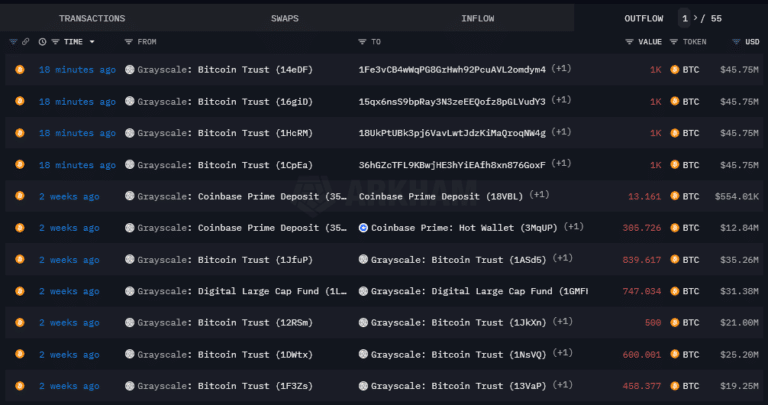

Starting on January 12 at 2:00 PM GMT, Grayscale, a digital asset investment firm, started transferring Bitcoin from its trust to Coinbase.

By the time this article was published, 4,000 BTC (about $200 million) had been sent, all of which went to Coinbase Prime, a major player in the Bitcoin ETF series that debuted yesterday.

Almost all ETF issuers, including Grayscale, use Coinbase as their broker and trading counterparty. As a result, this transfer probably represents trust outflows related to yesterday’s transactions.

Before today, there had been several withdrawals from the Grayscale Bitcoin wallets over about two weeks.

Although spot Bitcoin ETFs follow the real price of Bitcoin exactly, issuers are exempt from having to buy and sell Bitcoin in real time during trading hours.

Also Read: Grayscale Adds XRP And AVAX To Large Cap Fund, Drops MATIC