On the first day of trading for the inaugural spot Bitcoin ETFs in the United States, the total trading volume reached approximately $4.5 billion, as reported by Yahoo Finance.

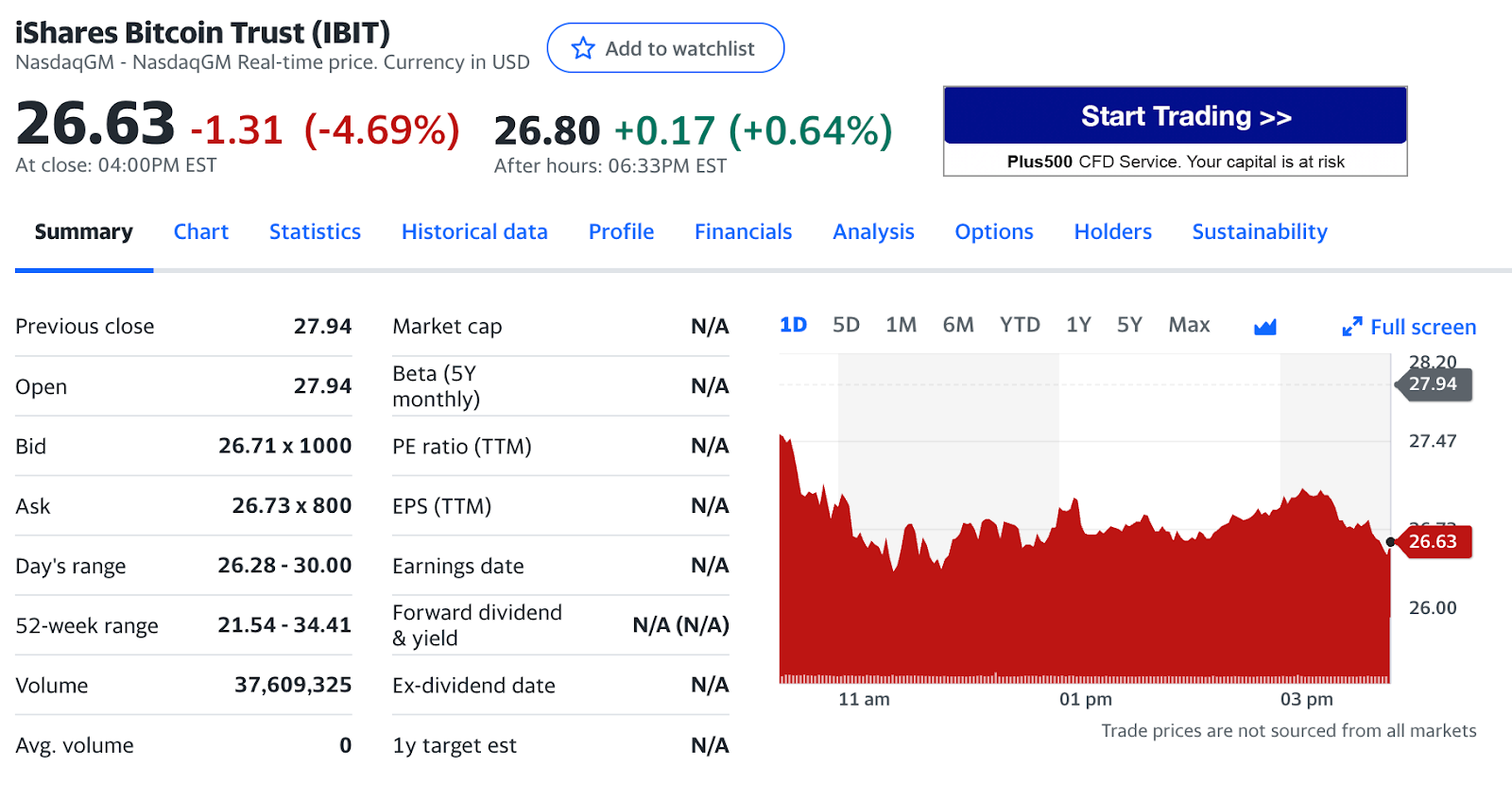

Additionally, BlackRock’s newly launched iShares Bitcoin Trust (IBIT) accounted for around 22% of the total volumes. The day started rapidly, with IBIT surpassing $1 billion in trade volume.

The Grayscale Bitcoin Trust (GBTC), which recently gained approval to convert into an ETF, contributed to about half of this trading activity and notched around $2.2 billion in total volume, making up 51% of the overall traded volume.

Meanwhile, Fidelity’s spot Bitcoin ETF, known as FBTC, secured the third spot, experiencing a remarkable $673 million in trading volume on its first day.

Bloomberg’s senior ETF analyst, Eric Balchunas, stated on Twitter that “GBTC volume prob ALL selling” for more cost-effective options like BlackRock and Fidelity’s ETFs. This perspective was also echoed by his colleague, James Seyffart.

Also Read: Crypto Milestone: Bitwise Launches First Bitcoin ETF on NYSE