Following a report, MicroStrategy Inc. stock (MSTR) took a hit this week following the approval of the first Bitcoin spot ETF on January 10th.

The company, led by Michael Saylor, has been deemed an indirect way to gain exposure to Bitcoin. However, with the arrival of Wall Street backed Bitcoin ETFs, MicroStrategy now faces stiff competition.

MicroStrategy stock has closely correlated with Bitcoin’s price since Saylor started accumulating Bitcoin in the company’s treasury. However, this trend shifted in 2024, despite MSTR slightly outperforming Bitcoin in 2023.

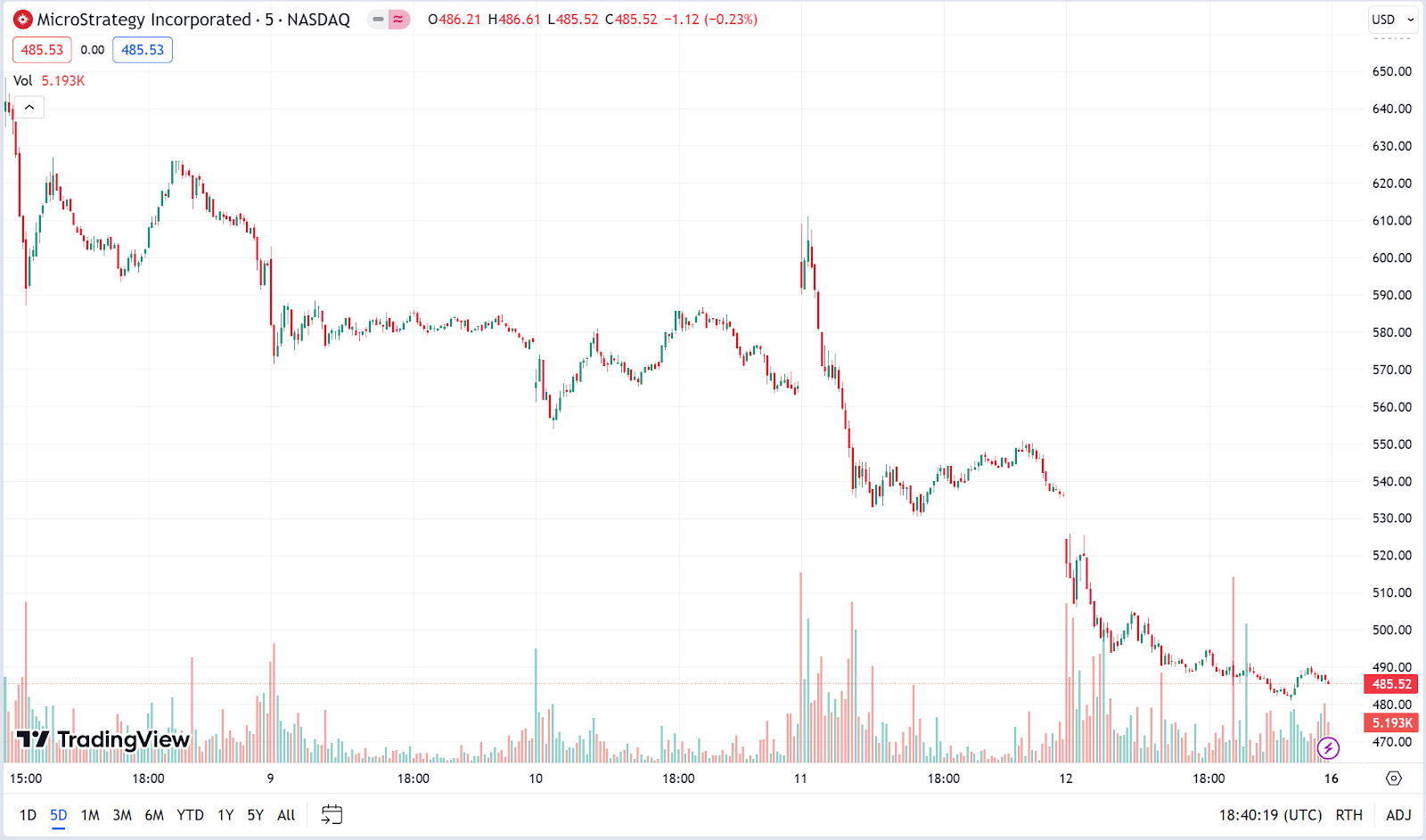

After peaking at $727 on January 3rd, MSTR plunged 19% to $485 by January 12th. This coincided with the first day of Bitcoin ETF trading on January 11th.

Ironically, MicroStrategy holds over 189,000 Bitcoins worth $8 billion, more than the company’s $6.6 billion market cap. Saylor started buying Bitcoin in August 2020 at an average price of $29,582.

With Bitcoin’s current price, MicroStrategy is sitting on $3.4 billion in unrealized profit from its Bitcoin bet.

Also Read: “Please buy more gold, silver and Bitcoin”: Robert Kiyosak