Bills challenging the classification of central bank digital currency (CBDC) as money have been submitted in Utah, South Carolina, South Dakota, and Tennessee.

These proposed laws aim to explicitly exclude CBDCs from being categorized as money, potentially posing significant obstacles to the introduction of a CBDC in the United States.

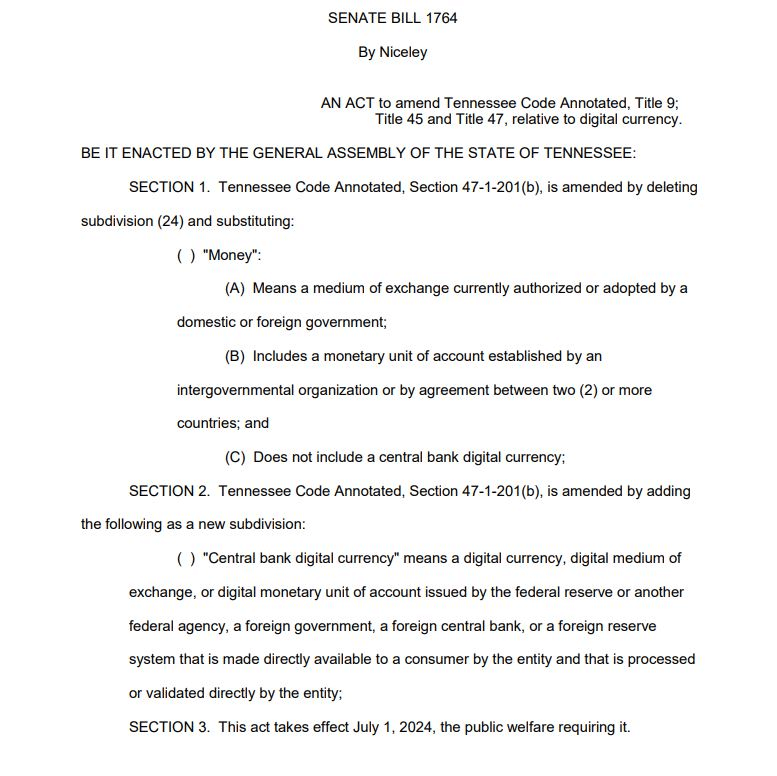

State Senator Frank Niceley presented a bill to the Tennessee Senate on January 12.

According to the current Tennessee Uniform Commercial Code (UCC), money is recognized as an authorized medium of exchange. However, the proposed bill would add the term “does not include any CBDC” to that definition.

The UCC is like a set of standardized rules for business deals in the United States. It provides a consistent framework for how businesses can interact and make transactions in different states.

The Utah CBDC bill suggests declaring that a central bank digital currency (CBDC) is not considered legal tender in physical form and is not recognized as legal tender within the state. It effectively excludes CBDC from the state’s definition of money under the Utah Specie Legal Tender Act and the state’s UCC.

Similarly, South Carolina, South Dakota, and Florida also signed similar legislation. Florida also banned using CBDCs issued by foreign governments and called on other states to use their commercial codes to institute similar prohibitions.

Also Read: Central Bank of Spain Selects Partners for CBDC Testing