Aave, one of the largest decentralized finance (DeFi) lending protocols, has introduced a new governance proposal to expand its GHO stablecoin across multiple blockchains. The initiative aims to increase liquidity and interoperability for the fledgling algorithmic stablecoin.

By potentially leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP) solution, Aave looks to port versions of GHO beyond just the Ethereum mainnet to enhance utility. The community governance process will determine if the expansion moves forward.

Launched on the Ethereum mainnet in July 2022, GHO was introduced as a decentralized multi-collateral stablecoin backed largely by ETH, staked ETH, and WBTC. It was designed to meet the growing demand for alternative stablecoins.

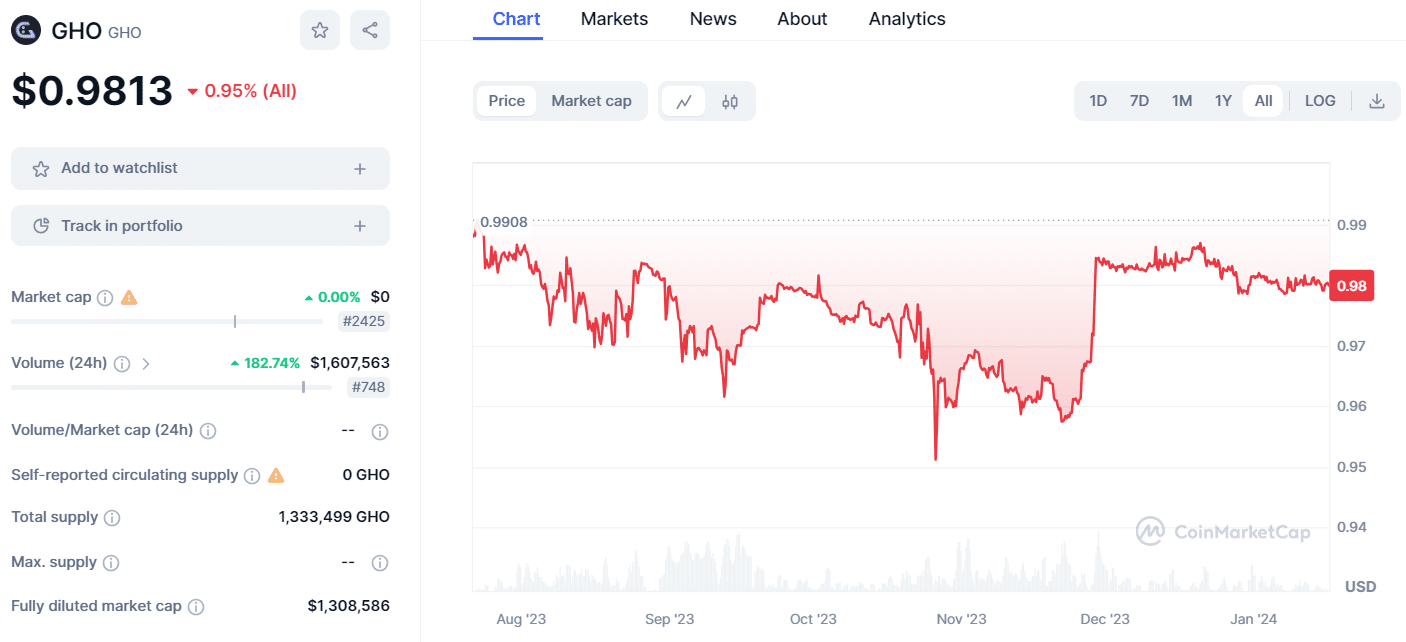

However, GHO has failed to consistently maintain its targeted $1 valuation, dipping below $0.98 as of January 2023, based on CoinMarketCap data. This has inhibited adoption and underscored issues facing algorithmic stablecoins.

To fix problems with available funds and the smooth exchange of information, Aave Labs proposed utilizing Chainlink’s communication tech to port GHO to selected partner networks picked by Aave governance.

Each chain would host a canonical version of GHO, with “facilitators” minting and burning tokens based on the DAO’s oversight. Facilitators would also manage liquidity transfers from the Ethereum anchor.

While boosting accessibility, total cross-chain GHO supply would still be constrained by the amount locked on the Ethereum mainnet. No concrete timeline was given. The proposal could positively impact GHO in several ways if successfully implemented after community approval.

Further, relaying price data across networks provides additional mechanisms to help maintain the peg and stabilization efforts. It offers a test case for improving algorithmic stablecoins through interoperability.

Aave’s initiative underscores algorithmic stablecoins’ dynamic and evolving nature, emphasizing the importance of continual improvement and bootstrap mechanisms. Utilizing features such as cross-chain transfers and shared governance enables different blockchain communities to stabilize assets collectively.

Also Read: Aave DeFi Community Votes to Address Security Vulnerabilities