In just one week, Bitcoin ETFs have surpassed silver ETFs in the U.S., with assets under management (AUM) reaching $27.5 billion within a week of trading, as reported by VeetaFi.

The surge is fueled by pent-up demand for Bitcoin, overtaking silver as the second-largest single commodity ETF. Grayscale’s Bitcoin Trust ETF (GBTC) alone holds 619,220 bitcoins.

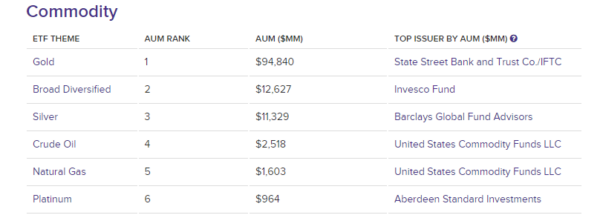

This transformation made GBTC the world’s largest Bitcoin ETF overnight. Silver now ranks third in AUM among single commodity ETFs, holding about $11.5 billion across five funds. Gold, with $96.3 billion AUM across 19 ETFs, still leads.

The rapid success of Bitcoin ETFs is driving optimism, with analysts anticipating increased market stability and liquidity. Competitive fee structures and growing interest might pave the way for more innovative crypto ETFs, including assets like Ethereum.

Bitcoin ETFs swiftly surpassing silver reflects the crypto’s growing mainstream embrace. With massive AUM and trading volumes, they signal evolving market dynamics, potentially heralding broader crypto ETF innovation.

Also Read: Bitcoin Miners Dump $450 Million in Bitcoin in a Single Day