More than $250 million worth of forced liquidations rocked the cryptocurrency market over the past 24 hours, according to CoinGlass data, aligning with a steep decline in the price of Bitcoin below the $40,500 level earlier today.

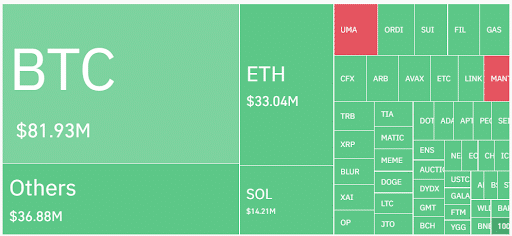

Most liquidated positions were concentrated in BTC and Ethereum (ETH), as Bitcoin dropped to nearly $40,500 currently, triggering a total of over $82 million in liquidations alone. Ethereum faced heavy losses as its price hit $2,950, accounting for $33 million worth of forced closes.

Despite market turbulence, trading data reveals that in recent hours, more traders have opened fresh long positions than short positions across exchanges. This signals confidence that the downturn will be temporary and Bitcoin will retain bullish momentum.

Exchanges Binance Bybit, Huobi, and OKX saw the highest volume of liquidations. Binance recorded the largest single liquidation event – closing out a long BTC trade valued at $7.31 million as prices tumbled.

Many analysts have attributed the downward price move to asset manager Grayscale aggressively selling its Bitcoin holdings via its Grayscale Bitcoin Trust (GBTC) amid decreasing demand.

Grayscale’s trust previously saw major outflows of over $550 million as crypto markets declined. Recent on-chain data showed Grayscale moved almost 10,000 BTC (over $400 million) to Coinbase Prime for additional liquidation just in the past week, totaling over 41,000 BTC exited since January 12th.

The sustained sell pressure from one of the sector’s largest institutions drives bearish sentiment and volatility. As markets stabilize, the timing and magnitude of any GBTC redemptions may continue weighing on prices.

Also Read: Bitcoin Overtakes Silver as Second-Largest US ETF Commodity