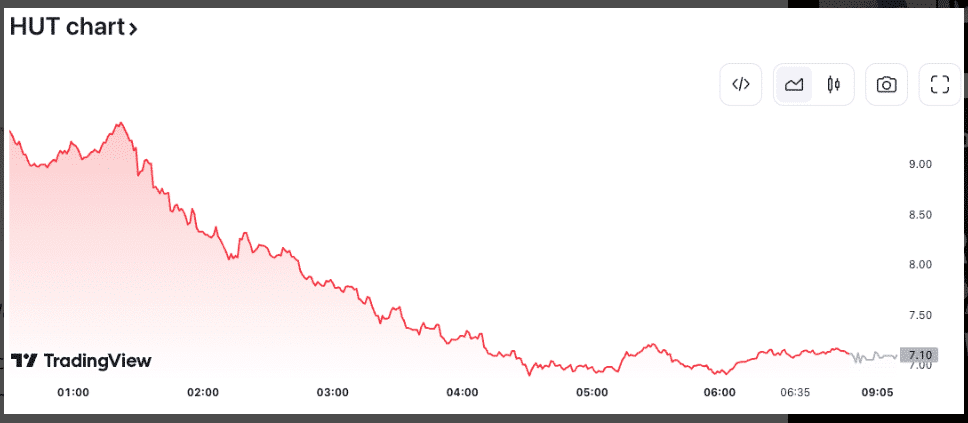

The stock price of Hut 8, one of the largest publicly traded bitcoin miners, plunged over 23% on January 18th following an unverified report alleging insider self-dealing related to a recent major merger. The sharp decline happened despite Hut 8 ringing the opening bell at Nasdaq headquarters earlier.

The selling was seemingly triggered by a short-seller report from JCapital Research claiming Hut 8’s recent merger partner, US Bitcoin Corp (USBTC), has concerning ties and a history of regulatory infractions.

The report alleged that USBTC leadership had hidden relationships with stock promoters accused of pump-and-dump schemes. It also stated that USBTC has failed to disclose a majority shareholder and pointed to past alleged loan defaults and government fines.

JCapital ultimately concluded that the recent Hut 8-USBTC $725 million merger deal places Hut 8 investors at risk of being on the wrong end of an “over-levered pump-and-dump” scheme.

The report arrived the same day Hut 8 leadership visited Nasdaq to celebrate completing the all-stock merger that made the combined entity one of the world’s largest public bitcoin miners.

While facing new criticism, Hut 8 continues increasing bitcoin holdings despite industry-wide capitulation pressures. This month, the company reported mining 453 BTC in December to bring total reserves to 9,195 BTC worth over $375 million.

Unlike distressed miners selling portions of bitcoin inventory, Hut 8’s expanding balance sheet highlights a growth trajectory aligned with its merged scale. However, the share price remains sensitive to the critical scrutiny of corporate decisions in the current down market.

Also Read: Hut 8 Mining: Stock Price Soars 1400% YTD