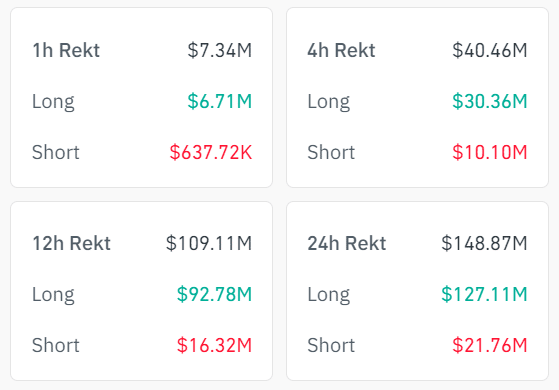

In the wake of intensified market turbulence, leveraged crypto positions faced over $144.96 million in liquidations within the last 24 hours.

According to Coinglass Data, long positions bore the brunt, suffering losses exceeding $123.08 million, while short positions accounted for a comparatively modest $22 million.

Bitcoin’s value dipped over 2.10%, plummeting below $41,000 to $40,913 by 7 a.m. ET. Since the SEC greenlit multiple spot Bitcoin ETFs 12 days ago, the leading cryptocurrency has shed over 7% of its value, plunging from above $48,000.

Amidst predictions of further decline below $40,000, BitMEX co-founder Arthur Hayes hedged with options, foreseeing downside movement. Bitcoin’s annualized volatility surged from 46% pre-ETF approval to over 52%, triggering nearly $30 million in leveraged Bitcoin liquidations.

The selling pressure has caused a drop in unrealized profits, from over 90% to just above 83%, offering a nuanced perspective on market dynamics.

The intensified market turbulence, marked by significant liquidations and Bitcoin’s value decline, suggests a cautious outlook with potential downside, impacting investor sentiment and profit dynamics.

Also Read: Bitcoin Price Decline Causes Liquidation of $250 Million