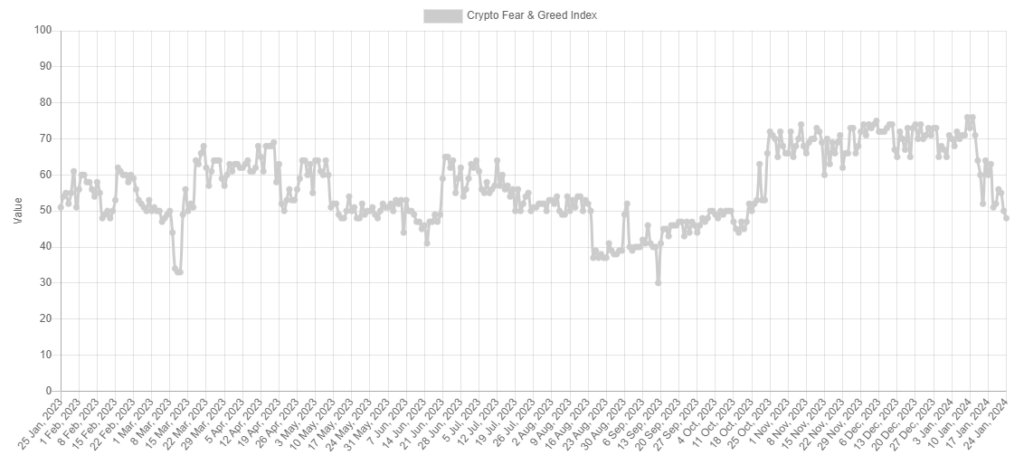

The cryptocurrency Fear & Greed Index has reached a 100-day low, with Bitcoin still declining in the wake of the United States government’s approval of spot exchange-traded funds (ETFs).

The index fell two points from the day before and fifteen points from the same day last week, when sentiment flashed “Greed,” to a score of 48 on January 24, falling into the “neutral” sentiment range.

On October 16, 2023, when Bitcoin was trading slightly above $28,500, the index saw a score of 47, representing a 100-day low point.

The index collects and aggregates information from six markets’ key performance indicators, including volatility (25%), market momentum and volume (25%), social media (15%), surveys (15%), Bitcoin’s dominance (10%), and trends (10%), to calculate the daily sentiment score for the cryptocurrency market.

Bitcoin surged to a year-high of almost $47,000 on January 8, just before several spot Bitcoin ETFs were approved in the U.S. However, the price has since dropped below $40,000 since introducing the new ETF products.

Since its conversion to an ETF, the Grayscale Bitcoin Trust (GBTC) has experienced over $2 billion in outflows, causing multiple days of net outflows from the top ten Bitcoin ETFs.

The index indicates that starting in late October, the market was firmly in “Greed” mode as it searched optimistically for ETF approvals.

Also Read: 15 Crucial Signs of Crypto Bull Run