Bitcoin has successfully breached the $42,000 mark for the first time in almost a week, indicating a recovery phase in the cryptocurrency market.

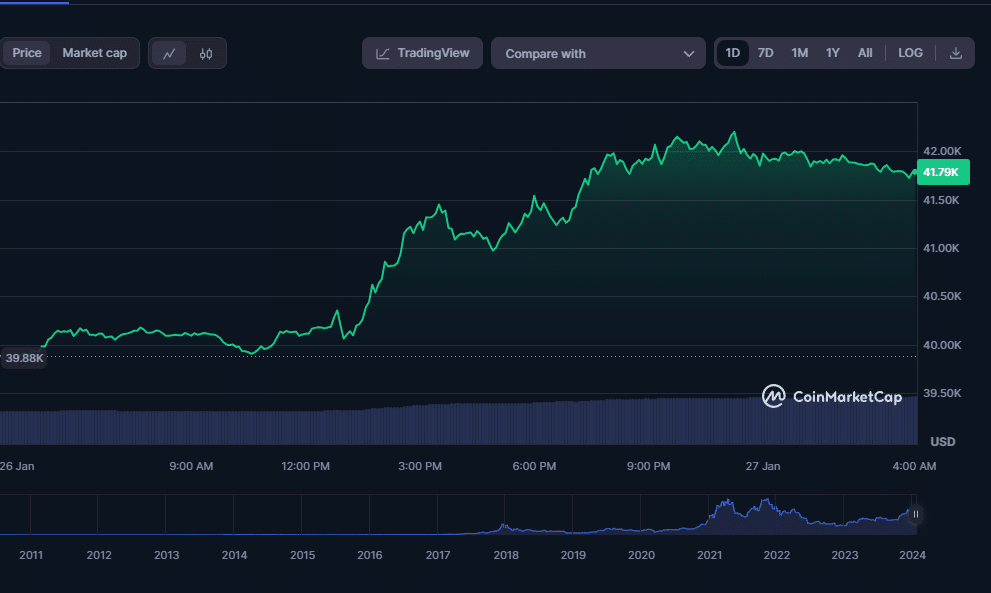

This surge comes after a period of instability triggered by the spot Bitcoin exchange-traded fund (ETF)-linked sell-off. According to Coinmarketcap, Bitcoin significantly jumped from $39,946 on January 26 to $41,836, a 4.96% daily increase.

The market is experiencing a reduction in outflows for Grayscale’s GBTC spot ETF. Research from BitMEX shows that GBTC experienced outflows of $394.1 million on January 25, a decrease from the previous days.

Despite these high outflows, the January 25 figure was the second lowest since spot Bitcoin ETF trading was established on January 11. Analysts observed the premiums and discounts for Bitcoin ETFs compressing over the last 10 days, indicating a stabilizing market.

Independent market analyst Yakuza noted that Bitcoin has potentially set a trap for bearish investors, with expectations of a drop to $32,000 being unfounded.