On Monday, the 10 spot Bitcoin ETFs experienced their first net inflows in a week, resulting in a stream in Bitcoin’s price. Despite ongoing net outflows at the Grayscale Bitcoin Trust (GBTC), ETF issuers collectively added over 4,200 bitcoins to their holdings, valued at approximately USD 183 million.

This positive development comes after a week of continuous daily outflows. Around 20,000 bitcoins outflowed between January 23 and January 26. The last instance of net inflow was observed on January 22, when the spot funds added just over 1,200 bitcoins.

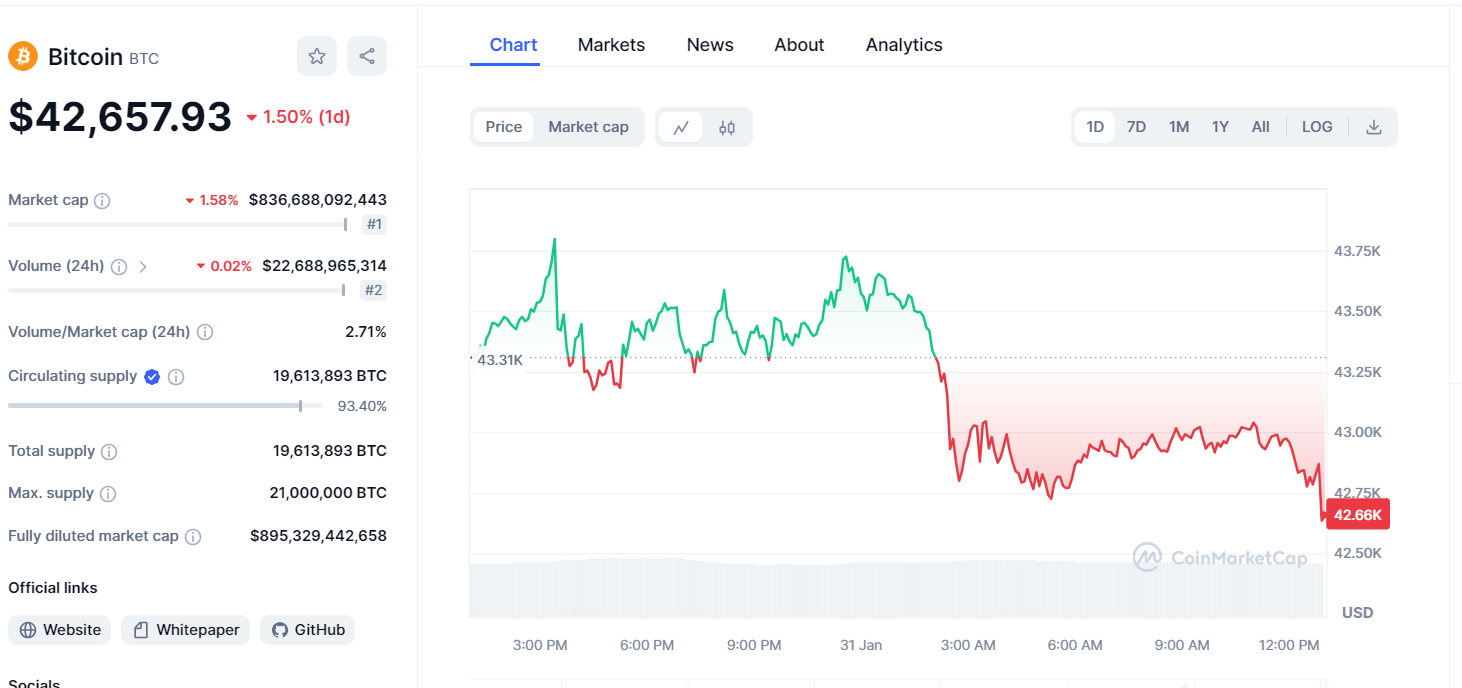

Bitcoin, which had dipped below USD 39,000 due to increased selling pressure last week, rebounded sharply to reach a high of USD 42,800 today, as per data from CoinMarketCap.

GBTC, which saw an average outflow of USD 40 million in the first six days following the launch of spot ETFs, witnessed a reduced outflow of USD 192 million on Monday, according to research firm BitMEX.

Since getting approval on January 10, the new Bitcoin ETFs have received over $1 billion in total net inflows, according to BitMEX.

These developments suggest that investors are eager to acquire BTC ETFs as an attractive platform for assessing Bitcoin without holding it.

The trading of ETFs on traditional stock exchanges will also have a convenience aspect. Thus, investors now find it easier for them to trade on crypto markets through these regulated instruments.

A trend in bitcoin ETFs that has led to net inflow and an increased Bitcoin price can be termed a sign of interest in cryptocurrency investments.

Bitcoin worth more than 4,200 was expected to add to holdings of the ETF, and outflows at GBTC were reduced. This may represent a milestone in the crypto market, but it would also be important to note the high level of volatility.

Also Read: Nine New Bitcoin ETFs Surpass 100K BTC in 7 Days of Trading