Bitcoin has historically outperformed other major assets, which also recommends an institutional portfolio allocation as high as 19.4% to maximize risk-adjusted returns, according to a 2023 research report from ARK Invest.

The investment management company released its annual report on January 31st, in which the study findings about the confluence of blockchain, AI, robots, and energy storage are presented.

The long-term performance of Bitcoin

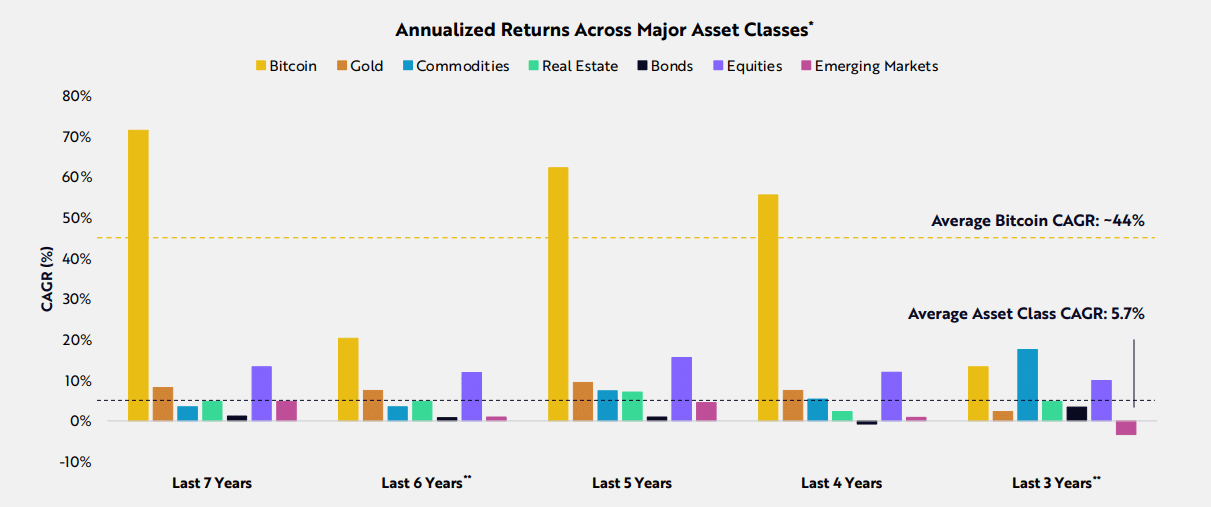

Data from ARK illustrates how well Bitcoin has performed over longer periods when compared to other significant traditional financial assets. While other major assets averaged 5.7% over the last seven years, Bitcoin’s annualized return was 44% on average.

The analysts point out that long-term asset ownership has paid off for Bitcoin investors with “long-term time horizons.”

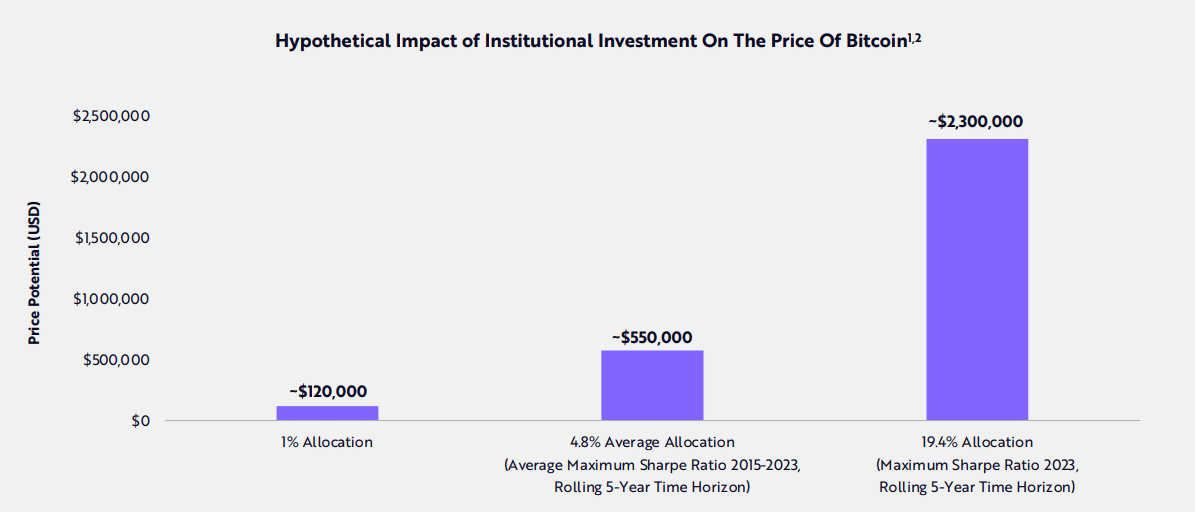

“According to our analysis, in 2015, the optimal allocation to maximize risk-adjusted returns on a 5-year time horizon would have been 0.5%. Since then, on the same basis, the average allocation to Bitcoin would have been 4.8%, and in 2023 alone, 19.4%,” stated in the annual report.

According to ARK’s analysis, institutional investments from the $250 trillion global investable asset base may allocate 19.4% of their portfolio to Bitcoin in a hypothetical scenario.

The price of one Bitcoin might reach $120,000 if all assets were invested by just 1% of the global asset base. The price of Bitcoin would reach $550,000 if the whole global investment base assigned the maximum average Sharpe ratio of 4.8% between 2015 and 2023.

ARK has allocated 19.4% of its portfolio to Bitcoin based on a comprehensive analysis of empirical market data to optimize risk-adjusted returns.

Also Read: Ark Investment Joins ETF Race, Buys Its Own Bitcoin ETF