Binance, one of the main cryptocurrency exchanges by trading volume, announced on February 6th the delisting of Aragon (ANT), Multichain (MULTI), Vai (VAI), and privacy coin Monero (XMR) effective February 20th.

As per the statement, Binance will halt trading on all respective trading pairs, such as ANT/BTC, MULTI/USDT, USDT/VAI, and XMR against BNB, BTC, ETH, and USDT. All related open orders will also stand canceled once the delisting takes effect.

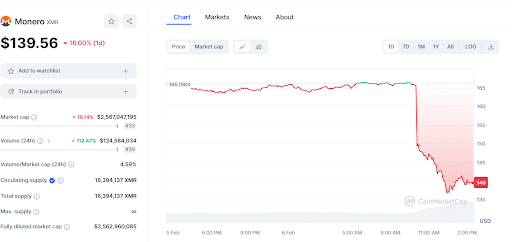

Among the four cryptos, anonymity-focused Monero and cross-chain asset transfer protocol Multichain have recorded sharp double-digit declines after the Binance announcement. XMR has fallen 17% to trade at $139.51 over the past 24 hours.

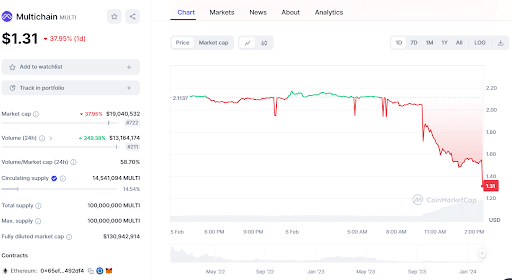

According to CoinMarketCap data, MULTI also lost over 29% to quote at $1.31 after this news broke.

Significant increases in trading volumes were also witnessed for both tokens, indicative of traders rapidly selling or transferring holdings in response. XMR trading volumes spiked 77% to $102 million, while MULTI saw a nearly 190% volume surge over 24 hours.

Interestingly, this is not the first instance of privacy coins facing the heat lately. Earlier in December 2023, leading rival exchange OKX announced it would cease XMR and Zcash deposits while completely delisting both from March 2024 onwards. Dash and Horizen were also removed, citing failure to satisfy listing criteria.

The escalating regulatory spotlight on private cryptocurrencies prompts key players to limit exposure. For Monero holders, the latest Binance delisting marks another blow, potentially impacting its mainstream standing and adoption.