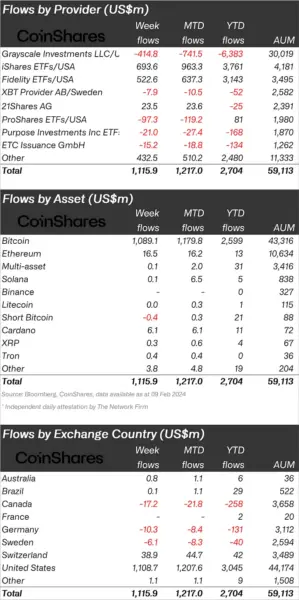

Investment products for digital assets experienced significant inflows of US$1.1 billion, bringing year-to-date inflows to US$2.7 billion. Nearly 98% of the inflows went into Bitcoin, and the price rise also improved attitudes toward Ethereum and Cardano.

Combined with recent price increases, overall assets under management (AuM), which stands at US$59 billion, is at its highest level since early 2022.

At the regional level, attention was still centered on the recently released spot-based Bitcoin ETFs in the US, which had net inflows of US$1.1 billion last week, bringing total inflows since inception on January 11th to US$2.8 billion.

Although the outflows from incumbents have greatly decreased, more outflows may occur in the upcoming months due to the possible sale of Genesis’ US$1.6 billion in assets.

Other area outflows have decreased, with small outflows of US$10 million from Germany and US$17 million from Canada. However, last week witnessed inflows of US$35 million into Switzerland.

Also Read: Spot Bitcoin ETFs Hit 200K BTC Milestone in Record Time

Nearly 98% of the inflows went into Bitcoin, and the price increase also helped Ethereum and Cardano, which got US$16 million and US$6 million in investment, respectively. Avalanche (US$0.5m), Polygon (US$0.4m), and Tron (US$0.4m) all had slight inflows.

There were small withdrawals of US$0.5 million from Uniswap and US$0.4 million from Short-bitcoin. While there were withdrawals of US$67 million from one issuer in blockchain equities, there were inflows of US$19 million from all other issuers.