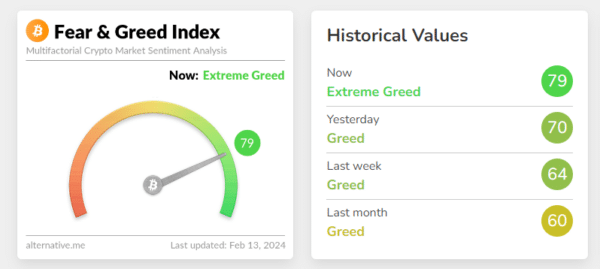

The Crypto Fear and Greed Index, a sentiment indicator that provides a quick overview of the mood in the crypto market, has spiked to its highest level since Bitcoin hit its all-time high in mid-November 2021.

Reaching 79 on February 13th, the index entered “extreme greed”, territory after Bitcoin rose above $50,000 on February 12th. The surge complements an impressive rise in Bitcoin which has gained 13% in value over the year.

Previously, on January 11th, the index hit 76, driven by enthusiasm surrounding the launch of the first U.S. spot Bitcoin-based ETFs.

Persisting uptrend and growing euphoria indicate the market may soon cease to be affected by selling associated with the ETF approval announcement. The Crypto Fear and Greed Index, composed of such factors as Google Trends, surveys, and social media, is a tool that tries to represent traders’ behavior.

While, investors are recommended to take time and examine the instrument of their choice as per their investment objectives. The rush for greed reveals the volatile nature of cryptocurrency markets, which is at odds with the rising interest and institutional involvement.

Also Read: Peter Schiff Calls Bitcoin’s Recent Pump a “Pump and Dump”