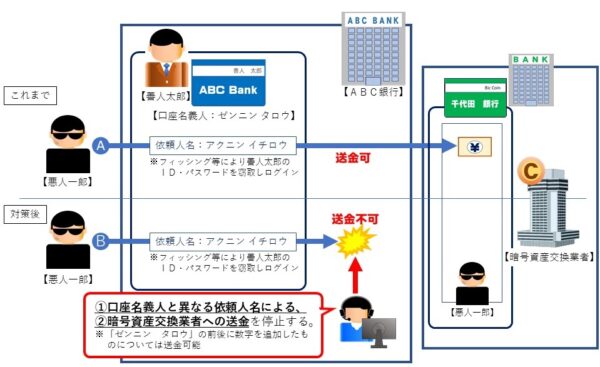

A worrying trend of fraudulent money transfers targeting internet banking users in Japan has emerged, with a concerning number of cases involving funds directed towards crypto-asset exchanges. Following an analysis by the National Police Agency (NPA) revealing this pattern, the Financial Services Agency (FSA) has joined forces with the NPA to call for strengthened user protection measures from financial institutions.

Recent data indicates that many of these fraudulent transfers are linked to phishing scams, where unsuspecting users are tricked into divulging personal information or authorizing illegitimate transactions. Additionally, “specialized fraud” cases, often involving social engineering tactics, also contribute to this issue, with stolen funds often funneled into crypto-assets due to their perceived anonymity and ease of transfer.

Joint Initiative Spurs Action:

The joined forces of NPA and FSA emphasized the need for risk-based approaches, tailoring protections based on factors like individual transfer statuses and destinations, particularly those involving crypto-asset exchange service providers.

On February 6, 2024, the FSA, in collaboration with the Japanese Bankers Association and other banking organizations, issued a request urging financial institutions to implement specific measures to combat this growing threat. These measures aim to address both phishing and specialized fraud tactics, particularly those targeting crypto-asset exchanges.

Proposed Countermeasures:

1. Blocking Mismatched Name Transfers: Institutions are encouraged to halt transactions where the sender’s name doesn’t match the account name, especially when funds are directed towards crypto-asset exchanges. This simple yet effective measure adds an extra layer of security against potential scams.

2. Enhanced Monitoring of Crypto Transactions: Financial institutions are advised to closely monitor transactions involving crypto-asset exchanges, focusing on detecting suspicious patterns and activity. Implementing advanced analytics and risk assessment strategies is crucial for identifying and preventing fraudulent transfers before they occur.

The call to action directly addresses various key players in the Japanese financial landscape, including:

- Japanese Bankers Association

- Regional Banks Association of Japan

- The Second Association of Regional Banks

- The National Association of Shinkin Banks

- Shinkumi Banks Association of Japan

- National Association of Labour Banks

- Japan Post Bank

- The Norinchukin Bank

- Shoko Chukin Bank

While institutions strengthen their defenses, public awareness remains crucial. Individuals are advised to stay vigilant against phishing scams, verify account details before initiating transactions, and remain cautious when dealing with crypto-assets.

Also Read: Japanese Lawmakers Seek to Establish New Web3 Policies