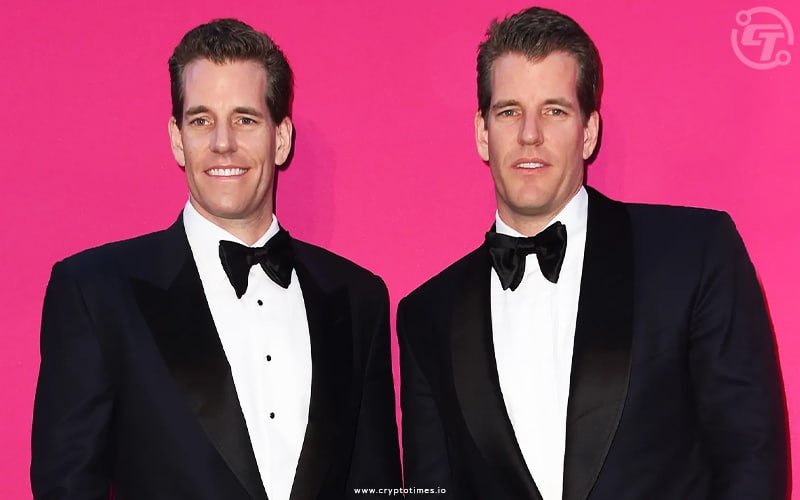

American cryptocurrency investor Cameron Winklevoss, the founder of Gemini crypto exchange, predicts a substantial surge in Bitcoin demand post the Bitcoin halving 2024, slated for April.

In a recent post on Twitter, Winklevoss highlighted that newly approved spot Bitcoin exchange-traded funds (ETFs) are accumulating BTC off the market at a rate ten times higher than daily minting.

He emphasized that if this trend persists, demand for Bitcoin will soar post-halving. With the halving event set to cut Bitcoin’s supply in half, Winklevoss suggested that if the appetite for spot BTC ETFs continues to grow, demand for Bitcoin will inevitably rise.

Bitcoin ETFs are currently removing ten times more bitcoin from the market each day than the amount being newly minted. If this trend continues after the halving, the ETFs could end up taking off twenty times more bitcoin daily than what’s being minted.

Muhammad Azhar noted that the influence of Bitcoin ETFs could profoundly shape the future crypto market landscape. He highlighted the ongoing shift in the supply-demand balance as ETF inflows surpass daily minting rates.

Also Read: Bitcoin-Yen Hits Record High, Reflects Fiat Stress in Japan