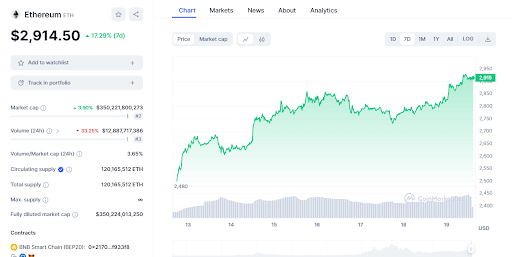

Ethereum (ETH) has surged over 16% in the last week to trade back above $2,900 levels—its highest since March 2021—as fundamental indicators point to the second-largest crypto likely sustaining its outperformance versus market leader Bitcoin.

In contrast to Ethereum’s double-digit jump, bitcoin (BTC) has risen a more moderate 8.5% over the same period, stalling around $52,000 below current record highs. This broad-based ETH rally reflects strengthening long-term trends, suggesting the flagship cryptocurrency’s supply outlook is more constructive than Bitcoin in the future.

With the Merge upgrade implementation on a date by Ethereum on September 15, 2022, now being a successful proof-of-stake blockchain, the circulating supply of ether has stopped growing significantly. Therefore, Bitcoin is fixed money, unchanged in quantity, and we will endeavor to do that because it is a halving process.

Specifically, on the net, Ethereum’s supply has fallen 0.209% year-over-year as 1.05 million ETH has been issued while 1.41 million has been burned or removed from circulation. Meanwhile, according to crypto data service Ultrasound figures, bitcoin’s supply increased by 1.71% over the same period.

The forthcoming iteration of Ethereum’s Dencun in March intends to enhance the platform’s scalability and capacity to support complex and more sophisticated applications. Moreover, the market anticipates SEC-positive decisions, which will launch the first U.S. spot ETFs tracking ether’s price by the end of this year.

With more fundamentals becoming Ethereum-centric, traders view limitless possibilities for either to thrive at the expense of Bitcoin, even after mass adoption.