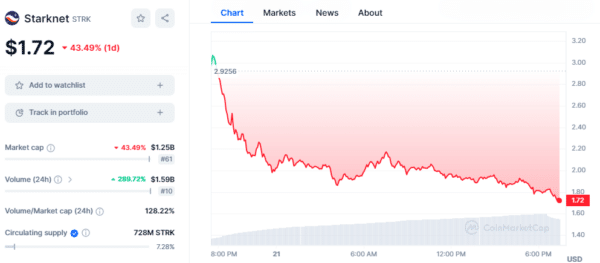

An Ethereum Layer-2 blockchain, Starknet (STRK) tokens, experienced a significant 43% value decline within a 24-hour trading period, with a total trading volume reaching $1.59 billion, as reported by CoinMarketCap.

Critics point to a 2022 token generation event, raising concerns about transparency. The token’s initial distribution of 728 million STRK to 1.3 million addresses led to significant selling pressure, possibly from recipients cashing in quickly.

Starknet, an Ethereum rollup platform using zero-knowledge proof technology, distributed over 220 million STRK to 100,000 wallets. Comparatively, other tokens experienced initial drops, like Arbitrum’s 50% loss in 2023, while some, like JUP from Solana-based exchange Jupiter, surged 70% on launch.

Half of STRK’s supply is earmarked for the Starknet Foundation, with 24.68% for early contributors and investors. However, criticism arises from the token’s 2022 generation event, with a vesting period starting in April 2024, potentially benefiting insiders.

The team hasn’t altered the vesting date, leaving core contributors and investors facing a substantial 13.1% supply unlock in April, valued at over $2.6 billion. Starknet defends its actions, emphasizing the event was documented, but critics argue for greater transparency in token issuance.

The controversy surrounding Starknet’s STRK token underscores the importance of transparency and fairness in token distribution and vesting schedules within the cryptocurrency space.

Also Read: Starknet User Count Decline Amid Token Drop Dissatisfaction