Bitcoin (BTC) surged to an all-time high of $69,325, surpassing its previous peak achieved in November 2021, amidst significant volatility driven by increased demand from spot exchange-traded funds (ETFs) in the United States.

However, unlike previous cycles, the leading cryptocurrency swiftly retraced its gains as bearish traders battled for dominance in the market.

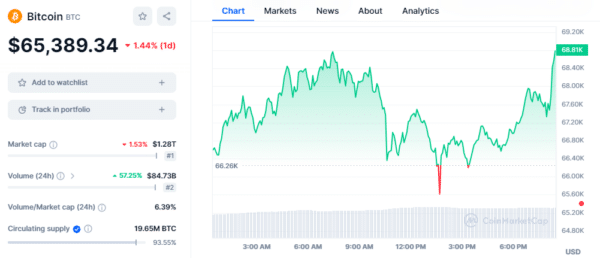

As of the time of publication, the price of Bitcoin had declined 2.50% to $65,389. An hour after Bitcoin reached its peak which gauges the size of the overall cryptocurrency market, fell 1.8%.

When the price of Bitcoin breaks through its all-time high, it usually rises for a few days. It increased from $20,000 to $24,200 in 2020 during 48 hours. Not until June 2022, during a down market, did it fall below $20,000 once more.

Before plunging to $897 for the next two weeks, bitcoin reached a peak of $1,350 in March 2017. Then it began a run that eventually reached a peak of $20,000.

The prompt response of today suggests that Bitcoin lacks the impetus needed to repeat the 2020 surge. A significant number of sell orders have been added to Binance at $70,000 and $71,000, which has added to the impasse.

In the last four hours, positions worth over $84 million in derivatives have been liquidated, with long positions accounting for the majority of these transactions. That is related to the recent days’ remarkably high funding rates.

Bitcoin looks to have been rejected from the $69,000 area, thus before attempting to breach the $69,000 barrier once more, it is likely to return to a prior level of support, such as $64,000 or perhaps $61,000. After 846 days, Bitcoin breaks an all-time high against USD, setting new milestones.

Bitcoin took more than three weeks in 2020 to reach $20,000. It was rejected several times and fell as low as $16,250 in increasing volatility before making a breakthrough. It seems probable that Bitcoin will move into a range-bound phase before attempting a new breakout.

Also Read: Bitcoin Price Hits $69K Breaks All-Time High After 846 Days