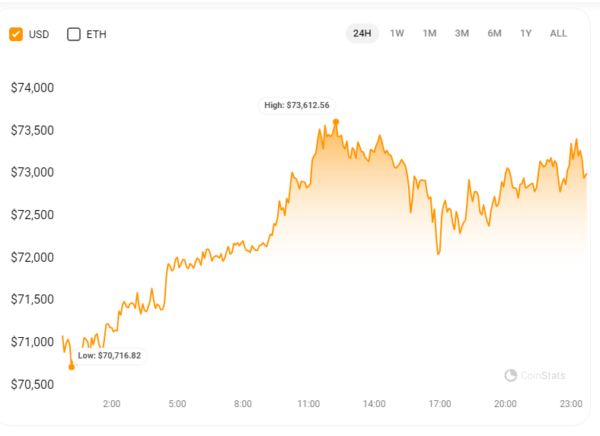

Bitcoin witnessed a remarkable surge as it soared to a record high of $73,612, marking its fourth ascension to unprecedented levels within six days. This surge is closely linked to the substantial inflows into US-based exchange-traded funds (ETFs) that are tethered to the cryptocurrency, demonstrating a shift in investor sentiment and strategy.

ETF Inflows Propel Bitcoin’s Rise

On Tuesday, US spot Bitcoin ETFs experienced a historic inflow exceeding $1 billion, with BlackRock’s IBIT leading the charge by attracting $849 million in daily flows. This surge in ETF interest plays a pivotal role in reducing the available circulating supply of Bitcoin as funds accumulate large quantities to back their offerings.

Ethereum Enjoys the Ripple Effect

Moreover, Ethereum also experienced a 3.3% increase, with its value touching $4,078. This development comes after a network upgrade named Dencun, which is poised to reduce transaction costs.

This upgrade promises to make operations on Ethereum’s network, including its associated Layer 2 chains, more affordable and efficient, potentially transforming the user experience and accelerating adoption.

Bitcoin and Ethereum’s achievements underscore the cryptocurrency market’s dynamic evolution. With ETFs drawing unprecedented capital and technological advancements making transactions more economical, the digital asset space is set to expand its influence and accessibility, marking a new chapter in its ongoing development.

Also Read: BlackRock IBIT Hits $14.7B Milestone in Bitcoin ETF