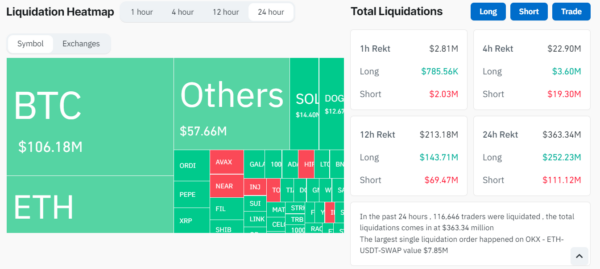

The first decentralized digital currency, Bitcoin reached a new all-time high of $72,569 before dropping below $70,000, which consequently resulted in over $363 million worth of leveraged contracts liquidated in the last 24 hours, as per Coinglass data.

In the short term, long position holders lost a total of $258 million and short sellers were down $103 million. This stands for the most massive liquidation of long positions that occurred on March 5. Bitcoin posted an 8.3% swing but found its footing at the $71,400 level.

Speculators have entered the market, betting on the reversal of the price trend, some of them even blaming the volatility on the ETFs approval. For the futures contracts, the open interest jumped 5% over the weekend, likely because of the tight stop being set up.

Most of the funds liquidated are the ones from Bitcoin and Ethereum combined, which amounted to $106.3 million for Bitcoin and $73.3 million for Ethereum. OKX was the exchange with the largest liquidations for the amount of $152 million, while Binance followed with the total of $128.4 million.

The overnight swing was the culprit of all liquidations, as positions across cryptocurrencies were in the red, and most of the losses occurred on the long positions. Analysts argue that despite the latest run-up, Bitcoin may be losing its grip, thus, it may need additional consolidation before further profits.

At the same time, the escalation of the inflation in the U.S. in February which was 3.2 % might affect the decision of the Federal Reserve on interest rates. Nevertheless, even if the inflation rate is high, experts contend that the cryptocurrency bull market is not coming to an end.

Also Read: Bitcoin $3,000 Drop Can Trigger $2B Bitcoin Long Liquidation