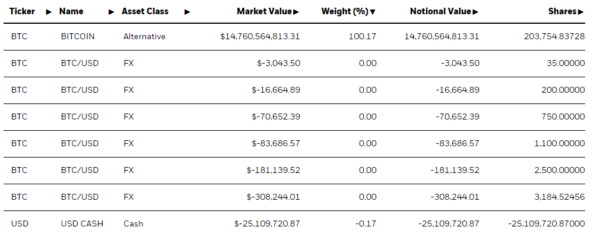

The world’s largest asset manager, BlackRock, iShares Bitcoin ETF (IBIT), hits $14.7B in notional value, becoming the largest among nine approved by the SEC on Jan. 10.

Fidelity’s FBTC comes in second with $9.2 billion in assets under management (AUM). Together, these two issuers have amassed over $17 billion in net inflows from investors.

While IBIT leads in Bitcoin holdings among new ETFs, MicroStrategy edges ahead with 205,000 BTC. BlackRock plans to expand its BTC ETF offerings globally, starting with Latin America through Brazil’s B3 stock exchange.

However, BlackRock’s spot Ethereum ETF faces uncertainty. Although the SEC has greenlit Bitcoin ETFs, it’s delaying decisions on Ethereum ETFs until May. Analysts doubt approval by then due to limited SEC communication with issuers.

Bloomberg’s Eric Balchunas and Variant Fund’s Jake Chervinsky predict slim chances for approval. Lack of dialogue between the SEC and issuers like BlackRock adds to the skepticism, though reports suggest meetings may occur this month.

BlackRock’s push into crypto ETFs reflects growing institutional interest in digital assets. Investors eagerly await regulatory clarity, anticipating broader adoption of crypto investment vehicles.

Also Read: BlackRock and Fidelity Surge, Grayscale’s Market Share Drops