Senior analyst at Bloomberg, Eric Balchunas, expressed confidence that all ten Bitcoin exchange-traded funds (ETFs) will survive in the upcoming year.

On March 13, Eric Balchunas posted on the X, saying, “I get asked a lot on intvs whether all Ten btc ETFs will survive and the answer is 100% yes they will all be here in a year.”

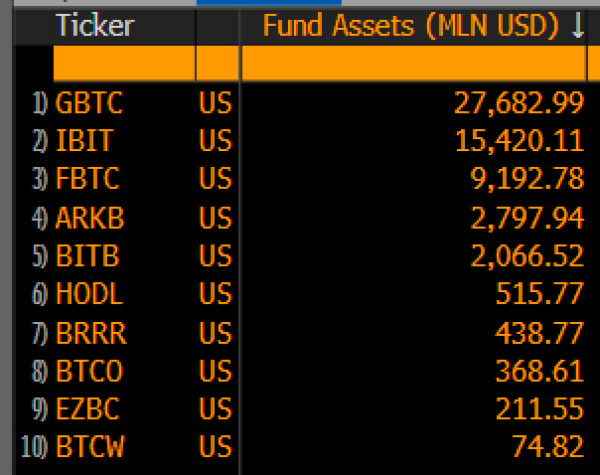

In the tweet, he also shared the data of the fund assets of all ten Bitcoin ETFs. As per the data, $GBTC holds the first position with $27 million in fund assets and $BTCW holds the last position with $74 million.

Eric also highlighted that, despite varying assets under management (AUM), even the lowest-ranking ETF, $BTCW, with $74 million AUM, is expected to endure.

Balchunas emphasized the notable expansion and interest in the bitcoin ETF field by pointing out that it ranks 16th out of 108 ETFs that were introduced in 2024, putting it among the top 15% in terms of performance.

However, fund managers of Bitcoin ETFs also took some steps to keep themselves in the game, before, the SEC approved the ten bitcoin ETFs.

Many firms, like BlackRock, Ark Invest/21Shares, Fidelity, Valkyrie, Invesco Galaxy, and WisdomTree, reduced their fees. Additionally, Bitwise and Hashdex rolled out their ETF marketing campaigns by releasing three advertisements in December.

According to Balchunas’ analysis, Bitcoin ETFs might be a viable long-term investment. The market’s general health and the survival of all ten ETFs could point to a stable and mature environment for investors.

As the use of Bitcoin ETFs grows, more nations may begin to approve cryptocurrency exchange-traded funds (ETFs). The approval of Ethereum ETFs is the focus now, despite a decreased likelihood of approval as per some analysts.

Also Read: Spot Bitcoin ETFs See Record $1 Billion Inflows In a Day