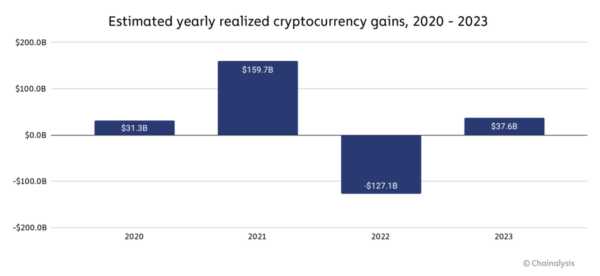

Cryptocurrencies industries generated an estimated $37.6 billion in gains last year, as the blockchain analytics company Chainalysis reported on Thursday.

These profits represent the cryptocurrency industry’s comeback from the $127.1 billion in losses it suffered in 2022, a year that saw some prominent companies, including FTX and Terra-Luna, fail or go bankrupt.

However, compared to the profits gained during the 2021 bull market, which totaled approximately $159.7 billion, the profits in 2023 were significantly lower.

Chainalysis stated in its analysis, “One possible explanation for this could be that investors in 2023 were less likely to convert crypto assets into cash, under the expectation that prices would rise even higher given that they didn’t surpass previous all-time highs at any point in 2023, unlike in 2021.”

In anticipation of spot bitcoin exchange-traded fund approvals in the United States, the value of bitcoin increased by over 150% last year.

The price of Bitcoin has risen dramatically so far this year, recently reaching an all-time high of $73,604. The top 30 cryptocurrencies are included in the GMCI 30 Index, which has grown by 63.5% this year.

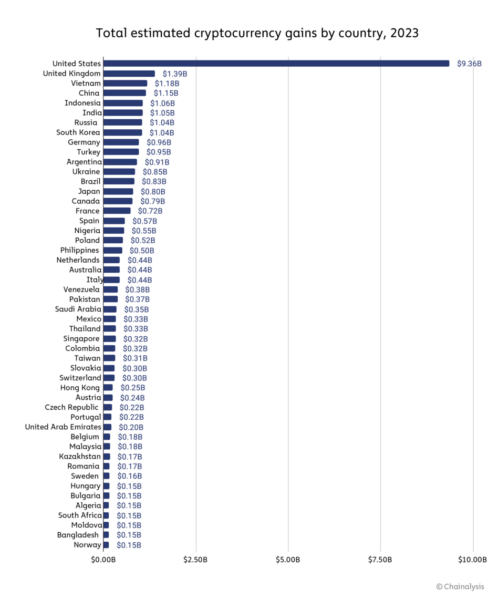

The United States led all other countries in this regard with a projected $9.36 billion in bitcoin gains last year. Next with $1.39 billion was the UK. According to Chainalysis, several Asian upper- and lower-middle-income nations, including Vietnam, China, Indonesia, and India, reported gains over $1 billion, putting them in the top six.

“Countries in these income categories, and lower middle-income countries in particular, showed strong cryptocurrency adoption that remained notably resilient even through the recent bear market,” according to Chainalysis.

The report further added, “Our gains estimates suggest that many investors in those countries have benefited from their embrace of the asset class.”

What could 2024 have in store?

Looking at the positive trends of 2023 have carried over into 2024, with notable crypto assets like Bitcoin achieving all-time highs in the wake of Bitcoin ETF approvals and increased institutional adoption. If these trends continue, the Chainalysis report asserts that we may see gains more in line with those we saw in 2021. As of March 13, Bitcoin is up 65.4% and Ether is up 70.2% in 2024.

Also Read: Crypto Funds at Asset Giants Smash 2021’s Record Inflows