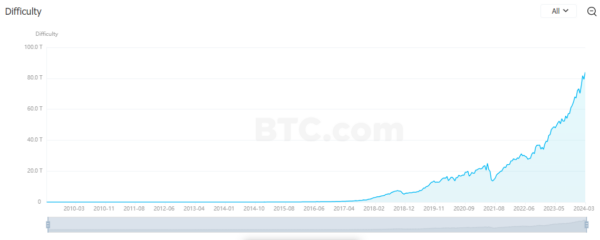

The first decentralized cryptocurrency, Bitcoin mining difficulty reached a new peak of 83.95 trillion hashes, along with a fresh all-time-high price of $73,835. This difficulty points out the challenge miners have in solving cryptographic puzzles due to the increased network participation.

This increase in difficulty, up 5.8% from the last measurement, occurred at a rate of 613.94 exahashes per second (EH/s), which means there is growing miner activity. The problem is predicted to be 84.17 trillion hashes by March 27.

Bitcoin’s price momentum has also been significant, with rewards for miners peaking at $78.89 million on March 11, the highest since October 2021. This rise is in line with Bitcoin’s surge to $73,835 before a slight pullback.

Market analysts view Bitcoin’s growth to the upcoming halving event in mid-April, where mining rewards will be cut in half from 6.25 BTC to 3.125 BTC, a process that has historically impacted supply dynamics and investor sentiment.

The combination of the record-high mining difficulty and the new price peak for Bitcoin illustrates the cryptocurrency’s ability to withstand regulatory uncertainties and market volatility and thus to attract more and more users.

Also Read: Bitcoin Mining Boom Fueled by Recent Crypto Surge