The United States government holds a surprisingly large portfolio of cryptocurrencies, worth roughly $15 billion. Bitcoin makes up the vast majority of these holdings, at over $14 billion. The news comes as cryptocurrency continues to be a major topic of debate, with some governments looking to regulate it and others embracing it.

Looking at the address controlled by the US government we at CryptoTimes have found that the US DoJ currency holds a vast majority of cryptocurrencies seized from various cases.

Bitcoin (BTC) taking the top spot at $14.39 billion, as the government holds 212.862K BTC and the current market price of Bitcoin is $67.7K. This also makes the US government one of the largest Bitcoin holding entities. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, falls far behind at $151.9 million.

The US government also appears to hold a variety of stablecoins, digital assets pegged to the value of traditional currencies, totaling $58.84 million.

We were also able to find where the US government stores its crypto holdings with the help of data from Arkham Intelligence.

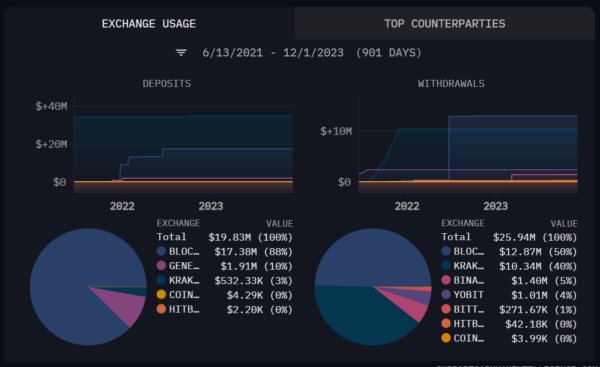

The majority, around $34.72 million, is held on Kraken, a prominent cryptocurrency exchange. BlockFi, another exchange known for its crypto lending products, stores $17.38 million of the government’s crypto.

On Contraray, the US government has withdrawn only $27 million so far. This in turn means that the government is in profit of almost $6 Billion.

What’s more interesting is that the government is also taking advantage of the defi protocol Aave as roughly $20 million stablecoins are lent by the government on the AAVE_V2. The government has supplied 18,669,986. aUSDC and 1,097,187.79 aUSDT.

Recently the government transferred 2000 bitcoins associated with the Silk Road, seized from James Zong, after executing a test run with 0.001 BTC.

Prior government actions include transferring BTC from the Silk Road hacker to Coinbase in March 2023, selling 9,861 BTC in April, and announcing plans to sell 2,934 BTC linked to the Silk Road case in January. Additionally, 15,085 BTC seized from the Bitfinex exchange hacker were transferred in February.

These developments underscore the U.S. government’s significant presence in the cryptocurrency space and its strategic handling of digital assets.

Also Read: Bitcoin’s Resilience: A Path to $45K Amid Market Fluctuations