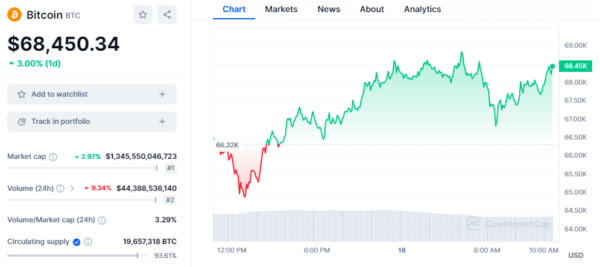

The first decentralized cryptocurrency, Bitcoin Price surged to around $68,500 on Monday, driven by memecoins amid volatility ahead of the Federal Open Market Committee (FOMC) meeting.

Memecoins also surged, with the sector’s market cap rising over $55 billion, driven by coins like SHIB, up 11.33%, DogWifHat (WIF), up 28%, and CORGIAI, up 8.5%. This surge extended to underlying chains like Solana (SOL), up 10.8% to $205, and Avalanche (AVAX), up 15% to $61.

Despite BTC dropping to lows of $64,500 over the weekend, it bounced back above $67,000. Investors showed confidence by selling heavy BTC puts, indicating reduced fear and willingness to buy the dip.

However, FOMC risks, including inflation and potential interest rate hikes, added macroeconomic concerns, affecting BTC sentiment. CME Fed Watch surveys predict unchanged interest rates with a 99% likelihood.

The index for smart contract platforms excluding Ethereum rose by 8.2%, surpassing the major digital assets index, which increased by 3.5%. Solana’s favor among traders sparked a wave of new meme tokens.

The crypto market’s resilience amid BTC volatility and the surge in memecoins reflects investor confidence despite looming FOMC risks and signals potential shifts in market sentiment towards alternative assets like Solana and meme tokens.

Also Read: Bitcoin Bulls vs. Bubble Bears: A Cryptocurrency Clash