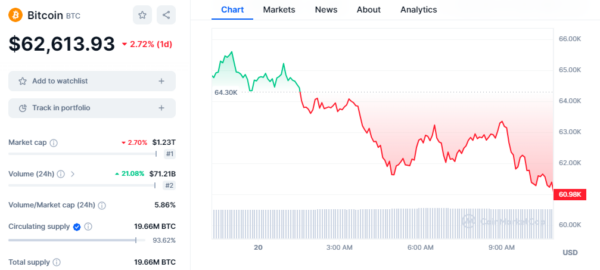

The first decentralized cryptocurrency, Bitcoin price plummeted on Tuesday as U.S.-listed spot exchange-traded funds (ETFs) lost favor, leading to an 8% decline to below $61,000, according to data from CoinMarketCap.

This marks the largest single-day percentage drop since November 9, 2022, when prices fell by over 14% due to the FTX exchange’s bankruptcy. The current slide has pulled prices back by 15% from recent highs of over $73,500.

Several factors contributed to this correction, including massive outflows from spot ETFs, with a record net outflow of $326 million on Tuesday and $643 million on Monday from Grayscale’s ETF.

Trader and economist Alex Kruger highlighted key reasons for the crash, including excessive leverage, Ethereum’s impact on the market, negative BTC ETF inflows, and the frenzy around Solana tokens.

Ether, the second-largest cryptocurrency, hit $4,000 after the Dencun upgrade but has since fallen to $3,130, partly due to reduced expectations of a U.S. SEC-approved ether spot ETF by May.

The market also appeared overheated earlier this month, with investors paying high funding rates for bullish futures bets, signaling a potential correction.

Investors are now awaiting the Federal Reserve’s rate decision and Jerome Powell’s press conference for insights into economic policies that could impact cryptocurrencies amid rising dollar index and U.S. Treasury yields, dampening risk asset appeal.

The Bitcoin price drop reflects a combination of factors including ETF outflows, excessive leverage, and market overheating, signaling a need for caution amid uncertainty over economic policies and regulatory developments.