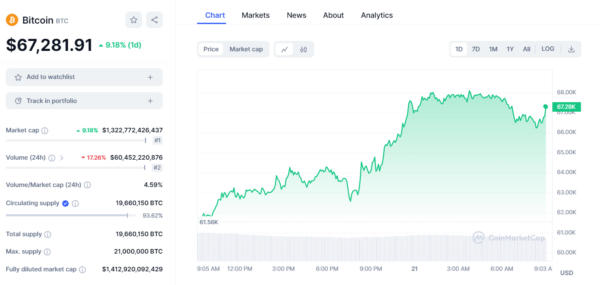

Crypto markets witnessed a sharp rebound on Wednesday, with Bitcoin (BTC) surging toward $67,000 on Wednesday after U.S. Federal Reserve Chair Jerome Powell struck a dovish tone following the central bank’s decision to maintain its outlook for three rate cuts this year.

BTC hit a daily high of $68,240, marking a remarkable recovery of over 10% from earlier levels. Ether (ETH) also erased a 6% dip triggered by reports of the Ethereum Foundation facing a confidential government inquiry and the SEC’s consideration of classifying the asset as a security.

As of early Thursday, BTC settled around $67, consolidating the gains from the Fed-fueled rally. The crypto market’s resilience in the face of macroeconomic challenges continues to capture investor attention.

Other major cryptocurrencies, including Dogecoin (DOGE) and Litecoin (LTC), led the gains in the crypto market. Traditional markets also rallied, with the S&P 500 index reaching a fresh all-time high, while the Nasdaq-100 gained 1.3%.

Crypto prices had suffered a steep correction over the past week, with BTC enduring its largest daily loss. Investors turned cautious before the Fed’s decision, concerned that recent high inflation might affect rate cuts.

However, the FOMC concluded that policymakers should keep interest rates and rate cut plans steady, eliminating the threat of a hawkish scenario and easing pressure on asset prices. Powell stated during a press conference that “we are making good progress on bringing inflation down” despite the higher inflation readings.

Also Read: Bitcoin Interest in Argentina Surges as Inflation Hits 270%