In the past three days, spot Bitcoin ETFs have seen a massive outflow of $742 million, with the Grayscale Bitcoin ETF (GBTC) leading the losses.

Despite this, Bitcoin’s price bounced back above $67,000 after the Federal Reserve took a dovish stance. Analysts are optimistic about Bitcoin’s future, especially with the upcoming halving next month.

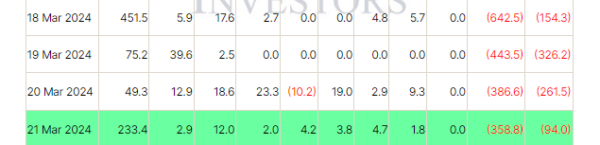

The outflows from spot Bitcoin ETFs started this week after a period of significant inflows earlier in March. On March 20 alone, net outflows from nine spot Bitcoin ETFs totaled $261 million.

Data from Farside Investors shows that March 18 and 19 saw outflows of $154.3 million and $326.2 million, respectively. GBTC had the largest outflow of $386 million on March 20, contributing to its total outflows exceeding $13.2 billion since its launch.

Other ETFs like Invesco Galaxy Bitcoin ETF (BTCO) also experienced outflows, while BlackRock’s iShares Bitcoin Trust (IBIT) had a relatively low net inflow of $49.3 million. Bitcoin advocate Max Keiser criticized Bitcoin ETF investors as ‘dumb money,’ highlighting their challenges in navigating Bitcoin’s volatility effectively.

Despite the ETF outflows, Bitcoin’s price rallied above $67,000 due to the Fed’s stance. Analysts like Michael van de Poppe expect Bitcoin to consolidate before potentially surging towards its all-time high again, but caution that a drop below $60,000 could lead to further weakness.

Also Read: Bernstein Elevates Bitcoin Forecast to $90K Amid Bullish Sentiment