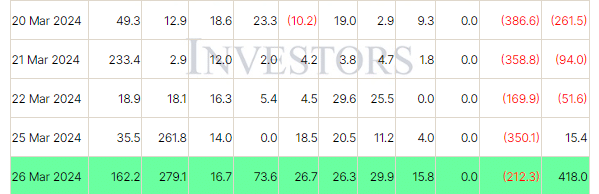

The second day of the week marked a significant rebound for spot Bitcoin ETFs, surpassing $400 million in inflows. This positive trend follows a week of substantial outflows due to GBTC liquidations.

Data from Farside Investors shows that on Tuesday, March 26th, spot Bitcoin ETFs collectively received a net inflow of $418 million. In contrast, Grayscale ETF GBTC experienced a net outflow of $212 million during the same period, an improvement from last week’s heavy outflows exceeding $300 million daily.

Fidelity’s ETF FBTC led the pack with a single-day net inflow of approximately $279 million, outperforming BlackRock for the second consecutive day. Bitwise Chief Investment Officer Matt Hougan remains optimistic about long-term ETF demand, citing varying adoption rates among financial advisors and national account platforms.

Hougan believes that the ongoing ETF launches will reduce downside risk for Bitcoin, making larger allocations like 3% or 5% feasible for investors. While true institutions may limit exposure to 1%, he sees 3% becoming the new normal for the wealth market in the coming years.

Matt Hougan is optimistic about the long-term demand for Bitcoin ETFs, foreseeing larger allocations becoming feasible for investors as downside risks reduce.

Also Read: Novogratz Bullish on Bitcoin ETF Amid Economic Turbulence