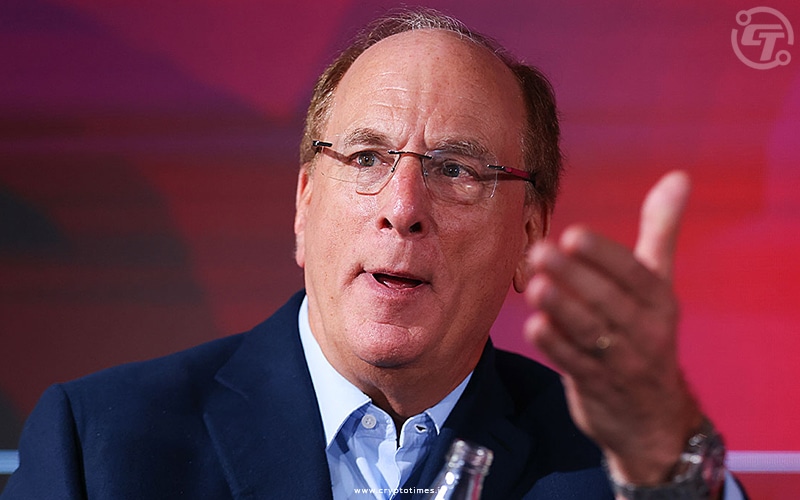

In a recent interview with FOX, Larry Fink, BlackRock’s CEO, shares belief in the probable acceptance of an Ether ETF even if the U.S. Securities and Exchange Commission (SEC) views Ethereum as a security.

The SEC’s stance is clearly present, as seen by Fink’s recent comments, which show a keen interest in investigating whether Ether is indeed a security. This might lead to increased oversight on Ether.

However, these ETFs do come with certain inherent challenges, such as ever-present compliance issues. Fink prefers to remain hopeful regarding the prospects of an Ether ETF.

BlackRock filed its application, along with seven other issuers, to the SEC to set up an ether spot ETF. While the expert says the verdict from the agency in May is most probably positive, it is straightforward that the outcome will be negative even if the agency decides against it.

Fink noted that five months after the launch of the world’s first Bitcoin ETF, the iShares Bitcoin Fund (IBIT), it already has over $15 billion in assets, becoming the most successful ETF in history. “IBIT is the fastest-growing ETF in the history of ETFs,” Larry stated during this interview with Fox Business on Wednesday.

Bitcoin has been highlighted as a major driver of liquidity and transparency in the market thanks to its rapid growth. He is, however, surprised that the overall adoption of the technology has not suffered any hiccups.

“Look, I’m very bullish on the long-term viability of bitcoin,” he said. “We’re creating now a market that has more liquidity, more transparency, and I’m pleasantly surprised, and I would never have predicted that before.”

Although Fink didn’t share a strategy for an Ether ETF, he revealed plans to explore the Ether market in the future, saying, “We’ll see.”

Also Read: OpenAI to Partner with Selected U.S. Builders for GPT Testing