A DeFi platform, Prisma Finance, faces an $11.6 million exploit fallout, with $540,000 still at risk as the “white hat” hacker demands a public apology and team identification for fund return.

Prisma’s core contributor, “Frank,” outlined efforts to recover funds and prioritize user safety. The exploit stemmed from flawed MigrateTroveZap contracts, affecting 14 accounts, five of which remain “at risk” with over $500,000 in open positions.

Prisma proposed reducing liquidity and staked revenue to bolster reserves, emphasizing the isolation of the exploited contract from the core protocol. Despite Prisma’s recovery attempts, the hacker insists on an online conference for apology and accountability.

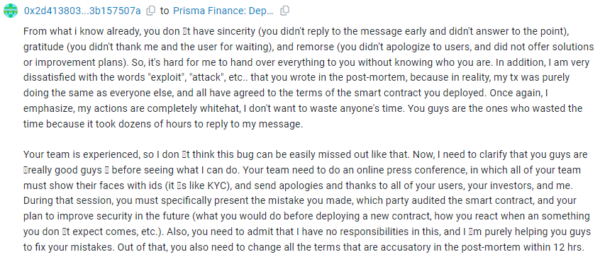

The dispute escalated as Prisma questioned the hacker’s sincerity, noting fund diversions to Ethereum (ETH) via Tornado Cash. Prisma’s total value locked after the attack dropped from $220 million to $86.7 million, per DefiLlama data.

This incident underscores DeFi’s security challenges and the importance of thorough smart contract audits and swift response mechanisms. Prisma aims to stabilize its platform and restore user trust amidst ongoing recovery efforts.

Also Read: Munchables Recovers $62.8 Million in Ether After Hack