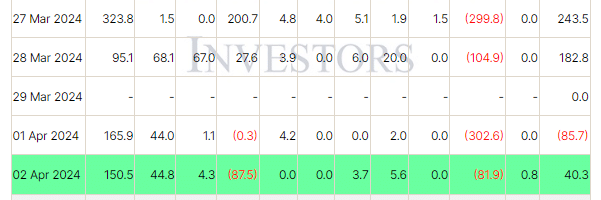

An American investment management firm, ARK 21 Shares Bitcoin ETF (ARKB) experienced a significant daily outflow of $87 million on April 2, surpassing Grayscale’s Bitcoin Trust (GBTC) for the first time since spot Bitcoin ETFs launched in the US. This outflow equates to about 1,300 BTC.

ARKB continued its outflows, losing $300,000 on April 1, its first-ever outflow day. In comparison, GBTC saw an outflow of $81.9 million, lower than its recent daily average of $254 million. Grayscale has lost $15.1 billion over three months.

Despite these outflows, BlackRock’s fund received a $150.5 million inflow, resulting in a net aggregate inflow of $40.3 million for the day. ARKB remains the third largest among newly launched spot ETFs, with $2.2 billion in assets under management (AUM), trailing behind BlackRock and Fidelity.

ARKB currently holds 44,662 BTC, making it the sixth largest BTC holder among funds and miners. However, GBTC still leads in total Bitcoin held, with around 329,000 BTC.

Bitcoin’s price has declined by 9% from last week’s high, reaching around $66,041 amid increasing ETF outflows. Additionally, ProShares launched the first 2x and -2x leveraged spot Bitcoin ETFs (BITU and SBIT), contributing to the growing activity in Bitcoin ETFs, which traded around $111 billion in volume in March alone.

Also Read: Spot Bitcoin ETF Trading Volume Hits $111 Billion in March