In March, spot Bitcoin exchange-traded funds (ETFs) saw a surge in trading volume, reaching $111 billion, nearly triple the volume observed in January and February.

Bloomberg ETF analyst Eric Balchunas highlighted these stats predicting April might have much bigger numbers.

BlackRock’s IBIT Bitcoin ETF dominated trading volume, followed by Grayscale’s GBTC and Fidelity’s FBTC. IBIT’s market share surpassed GBTC’s, reflecting growing interest in spot Bitcoin ETFs.

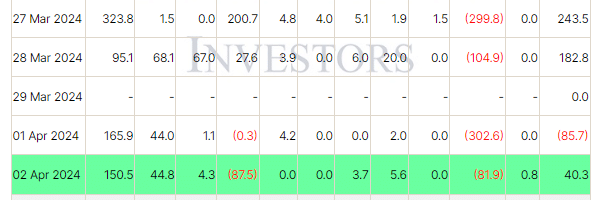

On April 1, spot Bitcoin ETFs experienced net outflows of $85.7 million. BlackRock’s IBIT had inflows of $165.9 million, but Grayscale saw outflows of $302.6 million. Fidelity’s FBTC had inflows of $44 million, while ARK Invest 21Shares ETF ARKB had minor outflows.

BlackRock and Fidelity’s ETFs reached assets of about $18 billion and $10 billion, respectively, in March, with strong inflows. In contrast, Grayscale’s GBTC faced significant outflows, dropping its assets by 46% to $22 million.

Spot Bitcoin ETFs have impacted the BTC markets, contributing to new all-time highs in March. Analysts anticipate a new cycle combining ETF success with the upcoming Bitcoin supply halving, less than 20 days away.

This news highlights the significant role of spot Bitcoin ETFs in the crypto market’s evolution, particularly BlackRock’s dominance and the impact of recent inflows and outflows.

Also Read: Spot Bitcoin ETFs Amass 500K BTC Valued at $35B in 54 Days