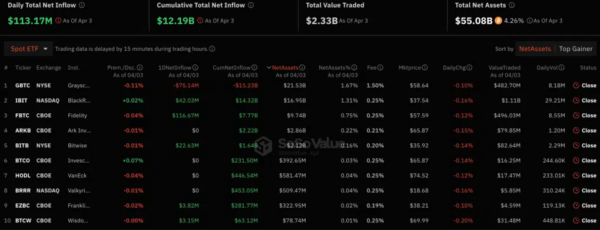

On April 3rd, the Spot Bitcoin ETF sector saw daily capital inflows surge to over $113 million, marking a significant increase, according to SoSo Value reports.

A notable rebound in capital inflows after a period of decline. Fidelity’s spot Bitcoin ETF (FBTC) led the influx with $116.6 million, followed by iShares Bitcoin Trust (IBIT) at $42 million.

Conversely, Grayscale Bitcoin Trust ETF (GBTC) saw outflows of $75.1 million, hitting a new low since February’s end. On April 2, ARK Invest’s Bitcoin ETF (ARKB) experienced outflows of $87.5 million, surpassing GBTC for the first time. Total net inflows into spot Bitcoin ETFs reached $40.3 million, with significant contributions from BlackRock and Fidelity.

GBTC has faced consistent outflows since the launch of spot BTC ETFs in January, surpassing $15 billion. However, recent data shows changing outflow dynamics, with $87.5 million exiting ARKB and $81.9 million leaving GBTC.

The trend of outflows began in April, notably with $300,000 withdrawn from ARK Invest. These developments highlight shifting investor sentiments in the Bitcoin ETF market.

Also Read: Spot Bitcoin ETF Trading Volume Hits $111 Billion in March