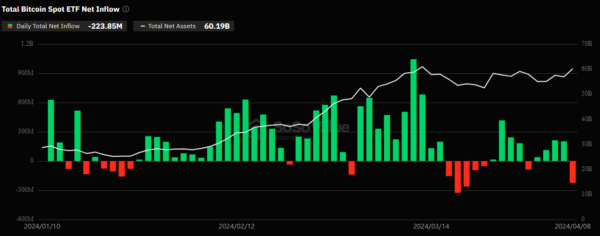

Bitcoin ETFs experienced a notable change on Monday, shifting from a streak of inflows to a significant outflow of $223 million.

This shift marked the largest outflow for Bitcoin ETFs in over two weeks, as reported by SoSo Value. The previous week saw four consecutive days of inflows totaling nearly $570 million, propelling Bitcoin’s price to $72,000.

However, Monday’s outflow led to a 6% decline in BTC’s daily trading volume, causing the price to retrace to $69,000. Among the ETFs, Bitwise saw the most substantial single-day net inflow at $40.3 million, while Grayscale’s ETF, GBTC, faced a withdrawal of nearly $303 million.

Since the SEC approved ETFs in January, Bitcoin’s market movements have largely influenced the net asset inflow into these instruments. With institutional funds expected to play a growing role, the London Stock Exchange is set to launch Bitcoin ETNs next month.

Analysts remain divided on Bitcoin’s short-term performance, with some like Anthony Scaramucci and Mark Plamer bullish, predicting a surge to over $150,000 post-halving. In contrast, a Deutsche Bank survey shows 30% of investors foresee Bitcoin dropping below $20,000 by year-end.

Also Read: Bitcoin Profits Slow as Long-Term Holders React: Glassnode Report