The upcoming Bitcoin halving is expected to put a strain on miners. With block rewards halved, their income will be cut significantly. Data suggests mining costs will double to keep pace, requiring a Bitcoin price above $80,000 for profitability.

CryptoQuant, Ki Young Ju, shared the data, which indicates that post-Bitcoin halving, the current cost of Bitcoin mining using Antminer S19 XPs will rise from $40,000 to $80,000.

Every 210,000 blocks, or roughly every four, there is a milestone known as the bitcoin halving, and the block reward for miners cuts by half. In addition to indirectly affecting the price of Bitcoin, the halving event significantly impacts miner behavior, as Bitcoin mining expenses double to earn the same amount of BTC.

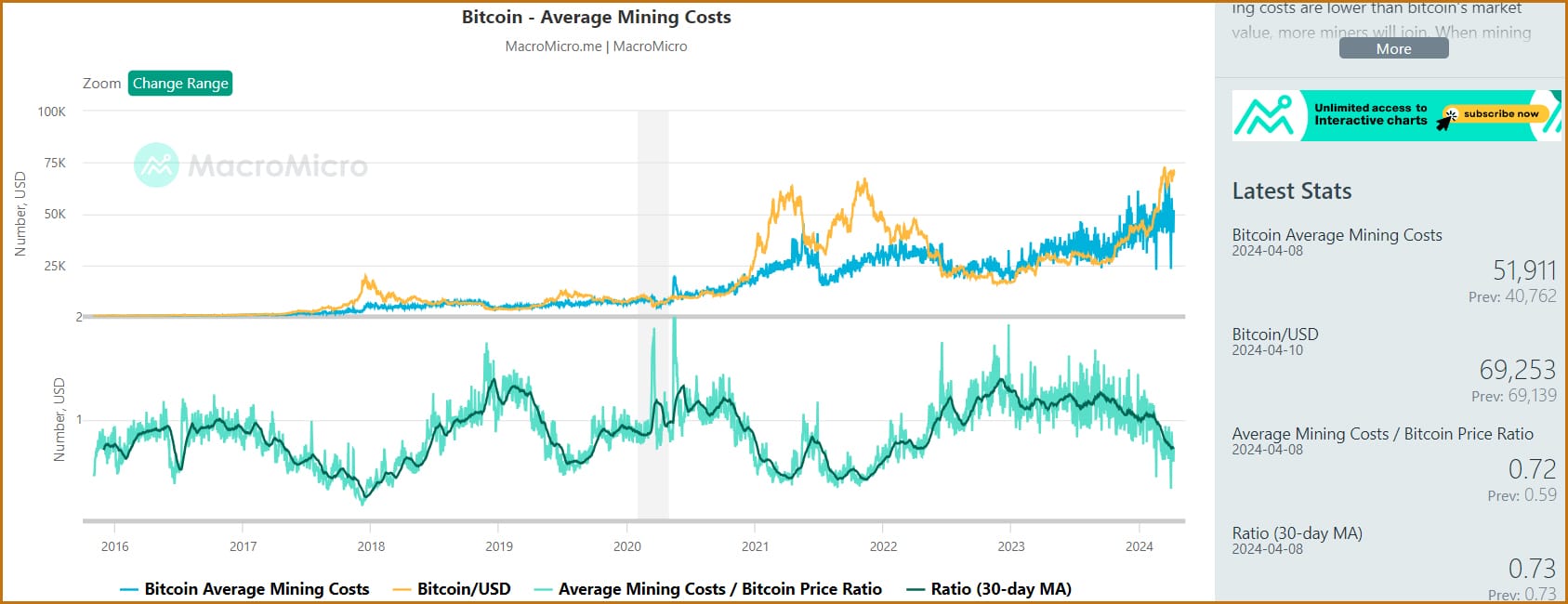

In May 2020, post-halving event, the price of bitcoin mining profitability increased above $30,000. As of April 10, the average cost of Bitcoin mining is $51,911.

However, the May 2020 halving also impacted BTC price which reached a new all-time high of $70,000 in the same cycle. The price of Bitcoin has gone over $72,000 ahead of the upcoming halving event. At the time of writing the price of Bitcoin is currently over $69,000.

The average cost of Bitcoin mining will increase after the April 20 halving to over $80,000, and the price of Bitcoin needs to rise above that level for miners to make a profit.

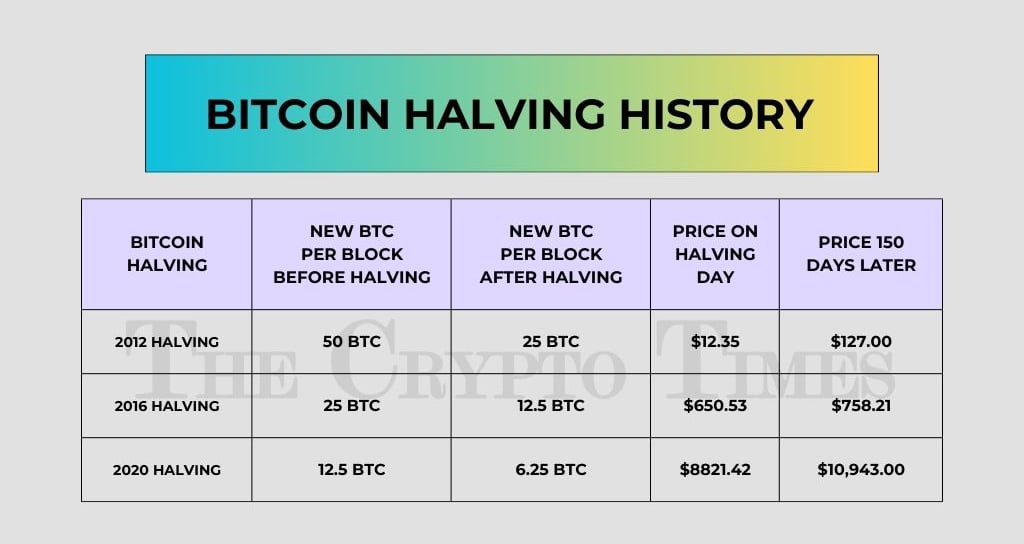

In the past, the price of Bitcoin has historically increased many times after the halving. After the halving in 2012, the price of Bitcoin shot up to $1,162, a gain of about 9,000%. Following the halving in 2016, the value of Bitcoin surged by approximately 4,200% to $19,800, and following the halving in 2020, it increased by nearly 683% to $69,000.

Thus, miners have continued to turn a profit despite concerns that they would go out of business with each halving. Some Bitcoin mining machines become outdated due to halving events as they are unable to keep up with the increased demand for hashing power.

Post-Bitcoin halving event, there’s a phase where the BTC price stays below Bitcoin mining profitability. It’s a wild ride marked by uncertainty, a rush to sell mining rigs, and the struggles of small-time miners facing frequent setbacks

Also Read: Bitcoin Miners Start Booking Profits Ahead of Halving