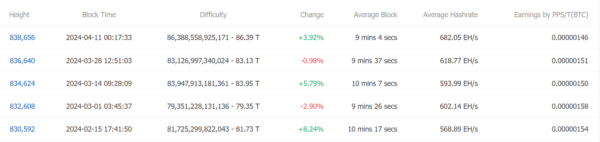

Bitcoin’s mining difficulty has reached a record level, setting a new record high at 86.39 trillion in the latest adjustment before the upcoming halving event. The most recent data shows a 3.4% increase in Bitcoin mining difficulty on April 10, reaching a new level from the 83 trillion set on March 28.

The difficulty level, which changes on average every two weeks to maintain the allocated block time of 10 minutes, is likewise structured on the Bitcoin network hash rate, which represents miners’ computational power.

With no more block rewards, miners are putting everything into maximizing their hashrate in the race for the miner reward reduction. The 7-day average hashrate has repeatedly reached new highs, now approaching 630 exahashes per second (EH/s).

The spike in mining difficulty has caused Bitcoin’s hash price to fall to $0.11 per petahash per second, according to Luxor’s Hashrate Index. The price is expected to be reduced by 50% immediately after the post-halving event.

The Bitcoin mining difficulty adjustment is expected to take place during the next 13 days, around April 24. While the impending halving that will cut the block reward for miners in half is scheduled to be eight days away, it brings along many unknown and brand-new challenges.

This is how the miners’ reward will decrease when the number of participants in the Bitcoin network increases and the mining difficulty adjusts to maintain the target block time.

Also Read: Will Bitcoin Reach $150,000 Post Halving?