Digital asset management giant Grayscale Bitcoin Trust (GBTC) experienced a record low outflow of $17.5 million on April 10, dropping nearly 90% from the previous day’s $154.9 million, coinciding with Bitcoin’s rebound to $71,064 following US inflation data.

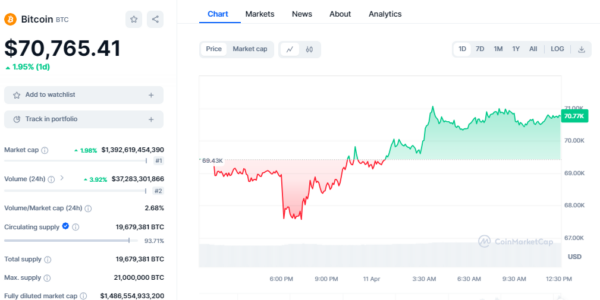

Bitcoin’s price rose by 2.57% in 24 hours, briefly dipping to $67,482 post-release of the US Consumer Price Index (CPI) for March at 3.5% year-on-year, sparking concerns of delayed Fed rate cuts.

Crypto analysts hint at a slowdown in GBTC outflows, totaling $16 billion since its spot Bitcoin ETF conversion in January. Apollo’s CEO, Thomas Fahrer, suggested this shift, noting a 95% drop in outflows compared to the week’s start.

Earlier on April 8, Grayscale saw $303 million in outflows, the most significant since Feb. 26’s $22.4 million. The daily average outflow over four months is $257.8 million.

In contrast, Fidelity Wise Origin Bitcoin Fund (FBTC) received $76.3 million inflows, iShares Bitcoin Trust (IBIT) $33.3 million, Bitwise Bitcoin ETF (BITB) $24.3 million, and ARK 21Shares Bitcoin ETF (ARKB) $7.3 million.

Bankrupt Genesis sold 36 million GBTC shares for 32,041 Bitcoin recently. These shifts suggest evolving investor sentiments amidst Bitcoin’s market dynamics and regulatory uncertainties.