Bitcoin Halving, a much-anticipated event in the crypto ecosystem, is being monitored closely by crypto enthusiasts across the globe as the price of the super volatile currency Bitcoin (BTC) is expected to set new benchmarks.

A short history of halving has shown us that the price of BTC and other cryptocurrencies have grown exponentially in a short time post the halving event. Trade analysts say that the halving events have the potential to disrupt markets, surge or plunge digital currencies and bring a shift in the economics of the crypto ecosystem.

In this article, we look at the history of halving and how the events unfolded to take BTC to newer heights through bullish sentiments and innovations.

BTC Halving

Halving is a programmed event where the reward for mining BTC gets slashed by 50% for every new block created by the miners. As per the algorithm developed by makers of BTC and blockchain technology, a total of 21 million BTCs could ever be generated and the fee for generating BTCs and creating blocks gets reduced by %)% every time a total of 2,10,000 blocks are formed, which usually takes four years. Such a mechanism was introduced to remain intact the “scarce” value of BTC through controlled demand and supply.

History of Bitcoin Halving

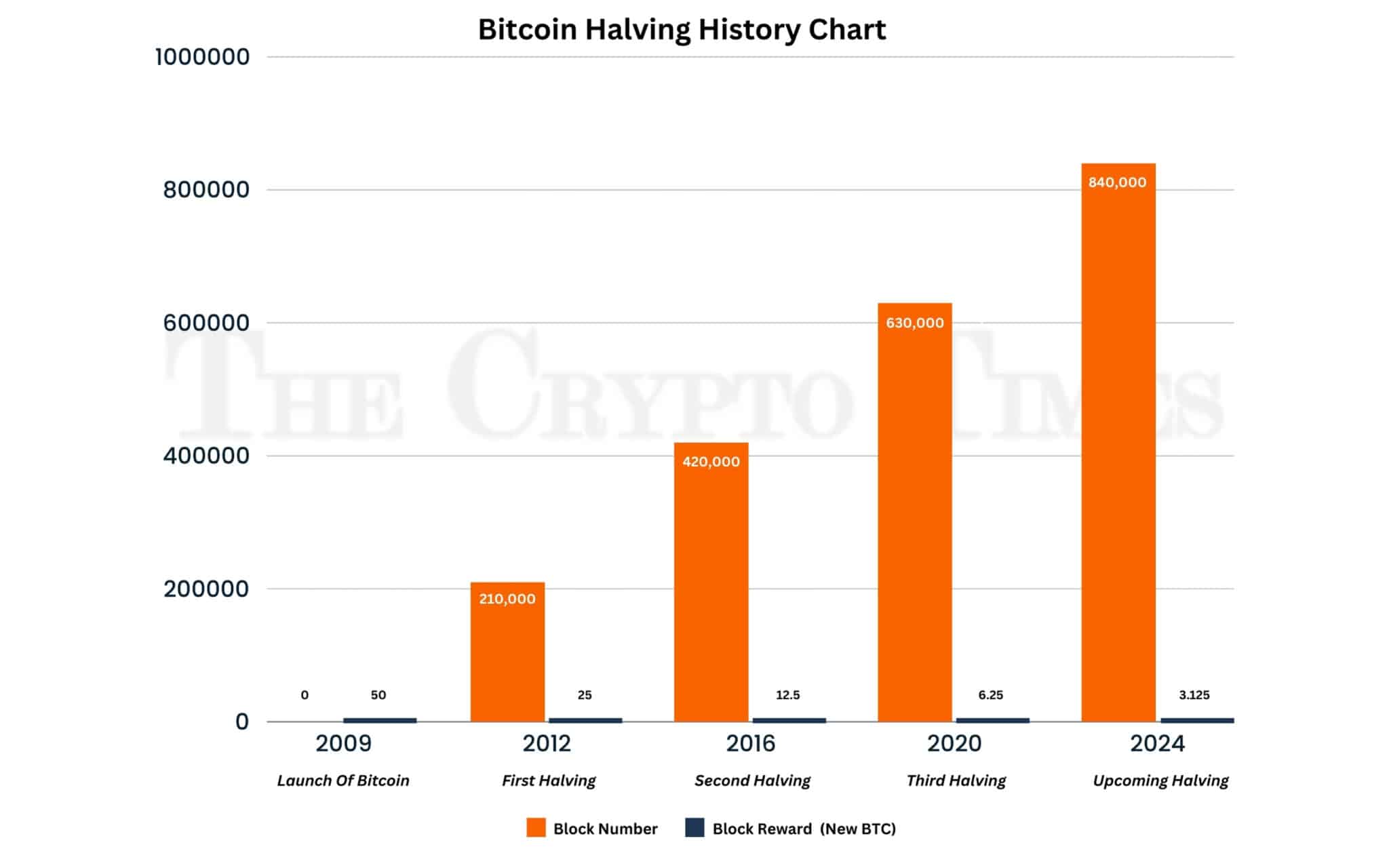

Since its launch in 2009, Bitcoin has experienced three halving events, occurring approximately every four years. The first was in 2012, followed by 2016, 2020, and the upcoming in 2024.

First Halving

The first Bitcoin halving took place after the network had confirmed 210,000 blocks, resulting in miners’ rewards being reduced from 50 to 25 BTC per block. At the moment of the halving, Bitcoin was priced at approximately $12 in the market. Following the halving, a bullish trend emerged, propelling Bitcoin’s price to $1,000 by the subsequent year.

Second Halving

The second Bitcoin halving occurred on July 9, 2016, at block 420,000, reducing the block reward to 12.5 BTC, coinciding with a market price of around $650. Following this event, Bitcoin witnessed another significant surge in value, with its price soaring to almost $20,000 within the subsequent 18 months, marking an extraordinary increase of 3,000%.

Third Halving

Following the third Bitcoin halving on May 11, 2020, occurring at block 630,000 and reducing the block reward to 6.25 BTC, the cryptocurrency demonstrated remarkable resilience amidst global economic uncertainty, with its price experiencing a surge. By April 2021, Bitcoin surpassed $69,000, reflecting an impressive 690% increase from its pre-halving value, which was approximately $9,000.

Fourth Halving

The upcoming fourth halving of Bitcoin is expected to occur on 19th April 2024, marked by the 840,000th block and a reward reduced to 3.125 BTC. At the current trading price of approximately $70,000, there is anticipation for a substantial surge in value post-halving.

Where will BTC reach post 2024 halving?

Although the exact price surge is challenging to predict, historical patterns suggest a significant upward momentum, potentially propelling Bitcoin to new highs, with projections ranging from surpassing $100,000 to reaching $200,000 in the subsequent years, fueled by increasing institutional adoption and mainstream acceptance.

Based on the historical data available, there appears to be a diminishing rate of increase in Bitcoin’s price following each halving event, with the growth rate reducing by a factor of approximately 3.5 to 3.9 compared to the previous halving cycle.

Applying this observed pattern, one might infer that for the 2024 halving, Bitcoin’s price could potentially experience an uptick of around 200% from its trough.

However, it’s essential to recognize that past performance is not indicative of future results, and various factors can influence Bitcoin’s price dynamics, including market sentiment, adoption trends, regulatory developments, and macroeconomic conditions.

Presently, the circulating supply of Bitcoins exceeds 19 million, leaving less than 2 million BTC to be mined before reaching the maximum cap of 21 million. Nevertheless, due to the mechanism of Bitcoin halving, the process of mining these remaining 2 million Bitcoins will extend over approximately a century.

The final Bitcoin halving is projected to occur in the year 2140, coinciding with the completion of the mining of the entire 21 million BTC supply.

As we near Bitcoin’s fourth halving, the crypto community is on the edge, eagerly waiting for the changes it will bring. With each halving, Bitcoin solidifies its status as the digital equivalent of gold, its limited supply mirroring that of precious metals.

Conclusion

History shows us that after these events, Bitcoin often experiences dramatic price increases, challenging traditional market rules. But beyond its financial gains, Bitcoin represents something more profound: a decentralized ideal, offering financial freedom in an uncertain world.

As we look ahead to the post-2024 halving landscape, one thing is clear: Bitcoin’s story is just beginning. It’s a testament to human innovation, a revolutionary force capable of reshaping economies, empowering individuals, and transforming our understanding of money itself.