A crucial stage in the history of cryptocurrencies is the Bitcoin halving event, which takes place about every four years. This incident has an effect on Bitcoin’s supply dynamics as well as its ecosystem as a whole, affecting several measures that show its acceptance and network activity.

Based on the past trend, after every Bitcoin halving there is a surge in Bitcoin addresses. The increase in active addresses is one such indicator that shows how involved and active users are in the Bitcoin network. Let’s explore the relationship between Bitcoin halving events and the increase in active addresses.

What is Bitcoin Halving?

The Bitcoin halving is a scheduled event that happens approximately every 210,000 blocks or around every four years in the blockchain network. During the halving, the reward for miners is reduced by 50% for successfully mining a new block. The upcoming halving event is expected to occur around April 20, 2024, coinciding with the completion of 840,000 blocks.

Look Back Into Past Bitcoin Halving Events

First Halving: November 28, 2012

On November 28, 2012, the first Bitcoin halving event happened where the reward for the miners was cut in half from 50 to 25 bitcoins per block.

At that time, the number of active addresses stood at 43,606. By April 9, 2013, approximately 132 days after the halving, the number of active addresses surged to 111,535 and Bitcoin price reached a then-all-time high of $230. After a year, active addresses had reached 200,988 With this, Bitcoin price has increased up to $1050.

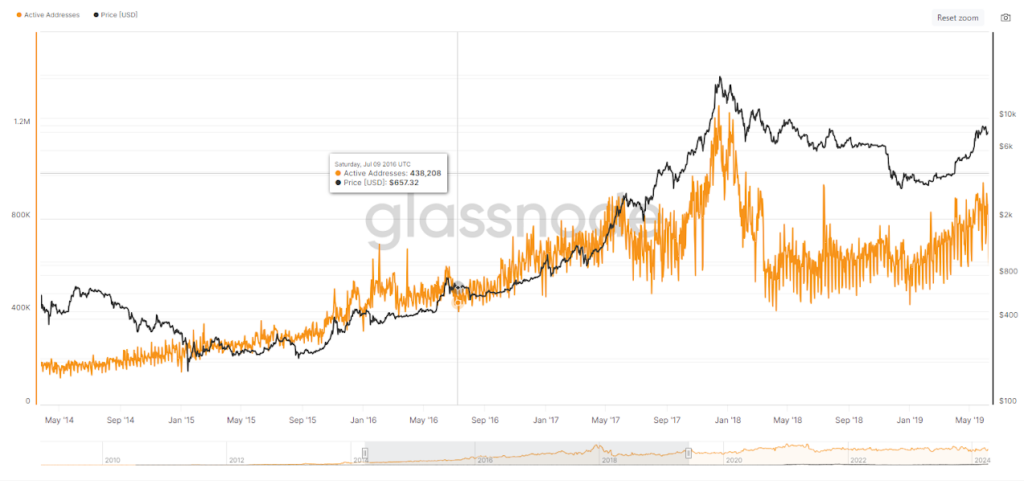

Second Halving: July 9, 2016

The first Bitcoin halving event took place on July 9, 2016, when the reward for miners was reduced from 25 to 12.5 bitcoins per block.

There were 438,208 active addresses in the Bitcoin network at the moment. The number of active addresses increased to 737,753 by July 7, 2017, indicating a notable increase in user activity with the price of Bitcoin reaching $2,500.

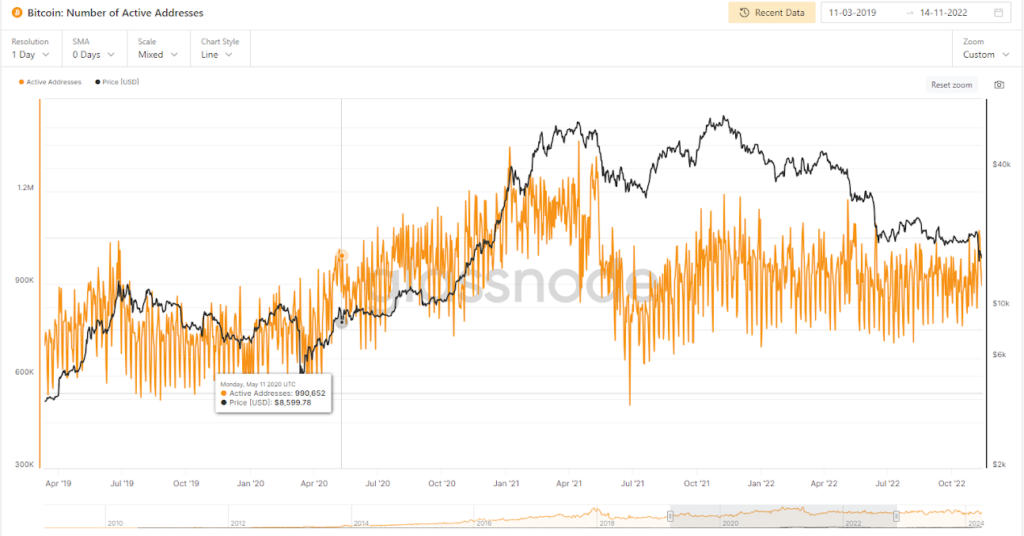

Third Halving: May 11, 2020

On May 11, 2020, Bitcoin underwent its third halving event, reducing the reward for miners from 12.5 to 6.25 bitcoins per block.

In the Bitcoin network at that moment, there were 990,652 active addresses. Active addresses reached 1,362,772 by April 15, 2021, about a year after the halving. His expansion was accompanied by a notable increase in Bitcoin’s value, which hit $63,200.

Why Does User Activity Increase After Halving?

Looking into the data after every Bitcoin halving event, user activity escalates due to scarcity factors.

Bitcoin becomes a scarcer asset as the manufacturing of new coins slows down due to a decline in the mining reward. Demand often surges when something is scarce because buyers anticipate an increase in value. Present users become more active in the network by either holding onto their bitcoins or trading more frequently because they anticipate price increases.

Furthermore, the possible profits may draw the attention of the new users. The media usually highlights the possibility of large price hikes, which encourages people to sign up for the network. This fresh user inflow adds even more fuel to the post-halving surge in overall user activity.

Following Bitcoin halvings, there has been a noticeable rise in user activity. This can be attributed to several factors, including the allure of possible gains, the scarcity-induced price increase, and increased media interest.

Looking Ahead to the Fourth Halving Event:

Future price swings are unknown in light of Bitcoin halving in 2024. Although past data indicates price appreciation post-halving, precise results are still uncertain. However, Based on historical patterns there is hope for Bitcoin’s growth potential because prior halvings have sparked greater investor interest and adoption, demonstrating resilience in the face of market volatility.

Also Read: Will Bitcoin Reach $150,000 Post Halving?