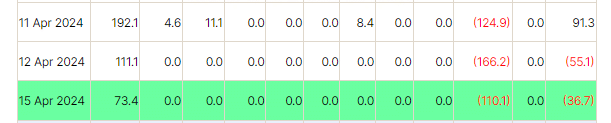

A major asset management company, BlackRock’s iShares Bitcoin Trust (IBIT), attracted $73.4 million in net inflows on April 15, despite a drop from the previous day’s $110.1 million, according to Farside Investors data.

This made IBIT the only U.S.-based spot Bitcoin fund to record inflows over the past two days. In contrast, other ETFs, except for Grayscale’s, experienced either zero inflows or lower.

However, IBIT’s inflows did not surpass outflows from the Grayscale Bitcoin Trust (GBTC), which saw $110.1 million in outflows on April 15, slowing from $166.2 million on April 14. Overall, all 10 spot Bitcoin ETFs observed net outflows totaling $55.1 million on April 14 and $36.7 million on April 15.

These outflows coincide with Bitcoin’s recent market turbulence, dropping 11.7% to $62,743 during the week. Global Bitcoin investment products also saw outflows of $126 million by April 12, reflecting investor caution according to CoinShares‘ James Butterfill.

The upcoming halving event on April 20, where Bitcoin’s issuance halves, adds to market uncertainty as traders anticipate its impact on prices.

Also Read: BlackRock Bitcoin ETF Took Seven Years of Planning